Every year on April 28th, we come together as Canadians to pay tribute to those who suffered a work-related injury or illness. On this Day of Mourning, we also remember those who have lost their lives while on the job.

During this time, we also reevaluate workplace safety. It's important that we advocate for workers who are performing dangerous jobs every single day.

This is where WSIB comes in.

How WSIB Program Works?

WSIB is the Workplace Safety and Insurance Board. It's the provincial agency that supports and insures workers who are injured on the job.

In turn, workers are entitled to many different benefits, even if they're working in the most dangerous jobs.

But, in order to qualify for these benefits, you have to file a claim with WSIB. From there, both you and your employer have to complete certain tasks to ensure that you're ready to go back to work.

How Does WSIB Protect Me?

The WSIB ensures that the injured workers will get compensation for the time that they're missing. They can help with loss of earnings, loss of retirement income, and compensation for medical bills.

But, it doesn't stop there. The WSIB has a full list of benefits.

Who Qualifies for WSIB?

In order to help their injured or ill employer qualify for help from the WSIB, someone must report an incident to the WSIB within six months of any of the following happen:

- The injured or ill employee loses time from work

- The injured or ill employee earns less than a regular day's pay

- The injured or ill employee gets healthcare treatment

- The injured or ill employee requires modified duties with full pay for more than seven days

Using the information that the employer, the worker, or the doctor submits, the WSIB can approve the employee for benefits and services to help with recovery.

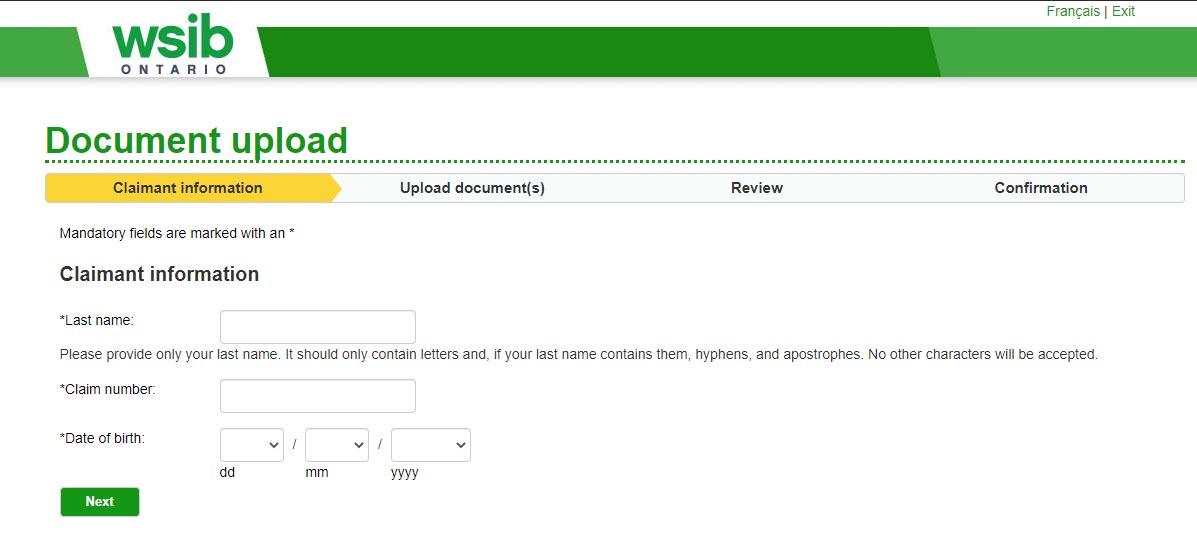

How Do I Make A WSIB Claim?

A WSIB claim starts when the worker, the employer, or the doctor makes a claim. No matter who starts the claim, it must happen within six months of the incident.

If the worker contracted a work-related illness, the timer starts once you find out about the illness.

Eventually, the worker, the employer, and the doctors all have to submit their own forms.

The worker can start the claim by calling WSIB. In turn, WSIB will send the worker a Worker's Report of Injury/Disease (Form 6). Alternatively, you can get a copy of this form on the WSIB website.

You should fill this form out and give a copy of it to your employer.

WSIB requires that your employer reports an injury within three days of notification. If the worker has to receive medical care or loses time from work due to the injury/illness, the employer must file an Employer's Report of Injury/Disease (Form 7). They must then give a copy of this document to the employee.

The injured or ill worker's doctor should complete a Health Professional's Report (Form 8). The physician should then give the worker a copy of page two to hand to their employer.

How Long Do WSIB Claims Last?

The length of a WSIB claim will depend on the seriousness of the worker's illness or injury. If there is a serious injury or illness that affects the worker for years, the workers' compensation claim could last for years.

If the worker suffers permanent impairment, they could receive compensation for the loss of earnings until the age of 65.

Even if the worker is not going to return to work following the incident, he/she must stay in touch with his/her employer and WSIB in the early stages of the case. If the worker doesn't, the WSIB could discontinue the benefits for non-cooperation.

The WSIB also requires that the worker tell them about any changes. This refers to changes in relation to the individual's medical condition and work status.

How Do I Get Paid From WSIB?

If the WSIB determines that you're eligible for payments, you'll receive direct deposits into your bank account. These will cover multiple monetary benefits.

First, you'll receive lost wages. Your employer must pay you in full for the day that you became injured or sick. This is even if you had to leave early due to illness or injury.

The WSIB will take care of the loss of wages that may occur after this. The amount that you'll get is 85% the difference between the amount you earned before the injury and the amount that you could earn after the injury.

Next, WSIB will cover healthcare-related costs. But, these costs have to directly relate to the injury or illness that you got from working.

Other benefits that you may be entitled to include the following:

- Work transition resources

- Assistance with finding a new job

- Skill assistance for those with permanent disabilities

- Monetary compensation for permanent impairments

- Allowances for clothing damaged by movement assistance tools

- Allowances for personal care and living expenses

You could even earn money for the loss in your retirement savings.

The WSIB will determine which of these benefits you're entitled to based on your situation. You will not automatically receive all of these benefits.

How Much Does My Employer Pay for WSIB?

The WSIB gets their funds from businesses. They pay premiums based on the earnings that they're getting from the program.

The collection of these funds go towards paying for injured or ill employees' lost wages, healthcare, and more.

The payment plan that your employer is under will depend on the number of insurable earnings that the business is making:

- Employers who are making more than $1,000,000 in insurable earnings will report and pay monthly

- Employers who are making insurable earnings between $20,000 and $999,999.99 will report and pay quarterly

- Employers who are making less than $20,000 in insurable earnings will report and pay annually

By feeding into the WSIB funds, these businesses are ensuring that their future injured/ill workers will get the help that they may need.

What Factors Are Used to Determine Premium Rates?

WSIB determines premium rates based on three different criteria:

- Insurable earnings

- Number of claims

- Costs of current claims

The WSIB uses the last six years to determine your premium rate. So, if you have a poor premium now, you may be able to get a better deal when those past problems rollover.

What Are the Risk Bands and How Do They Relate to Premium Rates?

Risk bands are the WSIB's way of categorizing businesses based on the level of risk that they bring. In other words, these businesses are being split into different categories based on how likely it is that their employees are going to need the insurance.

Each class has a set of risk bands. And, each risk band represents a rate that those specific businesses have to pay in relation to the class rate. The difference between each risk band rate is about five percent.

WSIB will adjust each business's risk by its individual experience.

What Is a WSIB Clearance Certificate?

A clearance certificate is a document that relieves a business' financial liability to the WSIB. It tells others that you're a professional who takes safety and legalities seriously. Overall, it looks very good for your business.

If the WSIB gives you a clearance certificate, it means that you've registered with the WSIB, filed all of your required forms, and reconciled any payments.

A clearance also helps businesses avoid liability. If you're hiring a contractor or subcontractor, a clearance certificate clears you of any liability to pay insurance premiums for the work that those individuals are doing.

What Does It Mean to Be in Good Standing?

There are few things that must happen for you to be in good standing:

- You have to open an account with the WSIB and provide all registration information and required documents

- You must be under the appropriate classification

- You must report all required premium amounts and any fulfilled reconciliations to the WSIB

- You must pay all premiums and other dues

You want to work hard to maintain good standing with the WSIB.

What Is Changing About Clearance Certificates?

As of September 15th, 2019, clearances automatically update for each business that is up-to-date on their payments. Now, the WSIB doesn't have to make an individual certificate for every single business.

These simplified clearances are just as valid as the original ones. So, if you receive one of these, it means you're in good standing.

The Right Life Insurance

When it comes to running your business, you want to make sure that you're in good graces with the WSIB. They're the organization that takes care of your injured/ill employees after all. So, you want to make sure that you're contributing so that they can financially help your employees later.

As you're insuring your employees with the WSIB, we also recommend looking into Group Benefits Insurance. Luckily, our team here at Insurdinary has pulled together everything you need to know to care for your organization.