You're gazing with dismay at the date. You can't avoid it any longer, it'll be time to file your taxes before you know it. More than 25% of Canadians feel the same way you do.

You have several options on how to do your taxes in Canada. You can go the old hardcopy route, download the paper, and wade through the mind-boggling multiple sections and subsections. Or you can get a professional to do it for you.

According to the CRA, more than 50% of Canadians still go to an agency and get their taxes done. This means you pay someone more than $100 to do it for you.

Or, you can do it yourself online with Wealthsimple Tax.

Disclaimer:

The content in this article or page is for informational purposes only. While we only conduct the most thorough research and evaluations, and update our content continuously, we cannot guarantee 100% accuracy of the details shown. Users may choose to visit the actual company website for more information.

Is Wealthsimple Tax Free?

Wealthsimple Tax is an online software program. If you go to your local office supply store, you'll pay anywhere from $35 and up for basic tax software. You can see our article on tax return software for some great suggestions.

You can do that, or you can sit down at your computer or laptop and go to wealthsimple.com and enter all your tax information for free! Yes, it's free to do your taxes with Wealthsimple! You will be asked if you valued their service to make a donation after you have filed your taxes!

Donations are entirely voluntary, however, you're probably going to find that their service is so easy to use and makes the whole process stress-free, so you will want to give a donation!

Is Wealthsimple Tax Safe?

There are a lot of scams out there and we understand the value of asking this question before entering personal data online. Wealthsimple knows you're concerned about how to do taxes online in Canada without fear of hackers collecting your personal data.

Rest assured, traffic to and from Wealthsimple Tax's online platform is encrypted and you can also enable the two-factor authentication for additional security. The Canadian Revenue Agency (CRA) and Revenue Quebec have certified Wealthsimple Tax because they are confident that it is accurate and safe.

How Do I Use Wealthsimple Tax?

If you know anything about how to do taxes, you have already collected your T4, T4e or any other relevant tax slips. Armed with these documents you can get started.

If you're not sure how to do your own taxes with Wealthsimple Tax, there's a great video you can view, or else you can follow these steps outlined below.

Create a Login

The first step to filing your taxes online is creating a secure login with your email and a password. Remember that this is personal financial information and be sure to choose a password that is secure and that you haven't used elsewhere.

You will be prompted to use at least eight characters and the login system will evaluate the strength of your password choice. Be sure to get a rating of 'good' at the very least.

You'll be asked where you heard about Wealthsimple Tax. Don't be afraid to type in Insurdinary blog as your source!

Get Started

A pop-up window will appear, allowing you to choose a name for your return. This is helpful if there is more than one person using this tax software from the same email account.

Now, it's time to start entering your information. You will need to enter your first, middle and last names, your social insurance number, date of birth and preferred language.

At this point, if you're filing for a deceased person, you can even indicate this information.

You will then have a series of questions about your address, your province of residence as of the end of the tax year, your marital status and dependents. You will also be asked if you disposed of your principal residence during the year. The current government will likely be imposing a tax on this, but it hasn't been enacted yet.

Enter Your Data

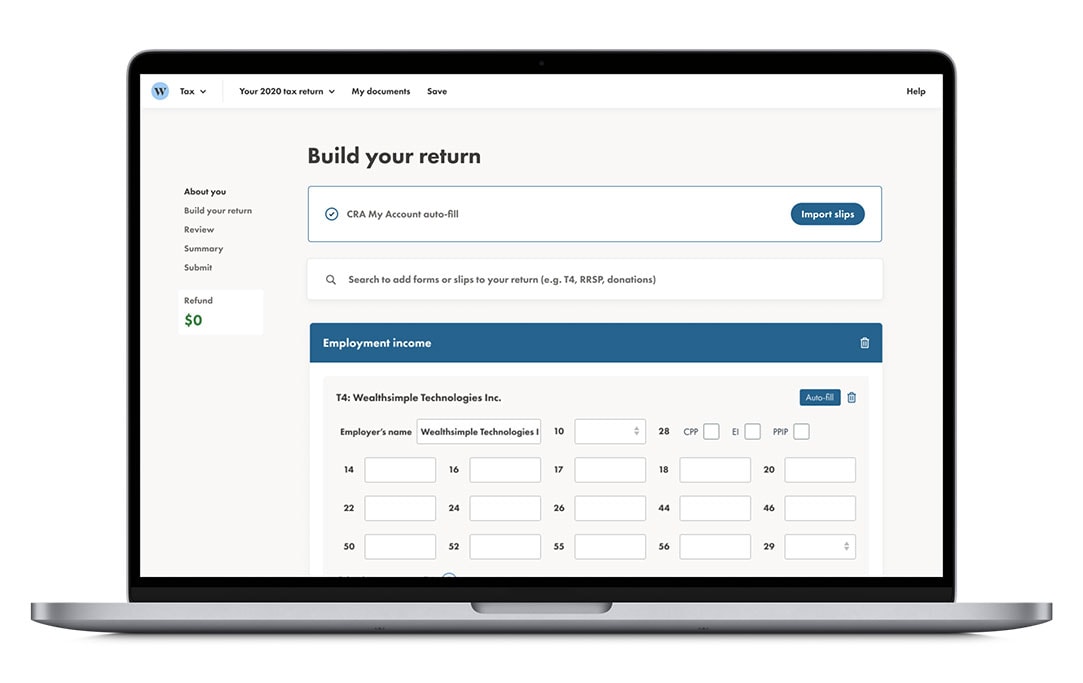

The next section is Build Your Return. Now it's time to enter the information from your T4s or information about scholarships, bursaries, fellowships, grants, and prizes, Employment Insurance (T4e) or any other income.

There is a helpful section called Suggestions which walks you through what you may need to enter here. You may have T2202s for college, university or other education programs. You may have T4A slips for pensions or annuities.

Did you know that teachers get deductions for money spent on classroom supplies? Did you know that if you're a volunteer firefighter you get a tax deduction? Did you know that there is an amount you can claim as a deduction if your employer obliged you to work from home due to the COVID lockdowns? Another great resource is our article on whether or physiotherapy is tax deductible. Within it, you'll find many other health related expenses that are as well.

There are deductions for students who have to subscribe to digital news and a deduction for a Climate Action Incentive (Ontario, Alberta, Saskatchewan and Manitoba only).

The good news is that even if you didn't know about these deductions, the Wealthsimple Tax online filing system does. You will get the option of scrolling through a drop-down menu to identify all the deductions you're eligible for.

Review Your Tax Return

Wealthsimple has a wonderful Check & Optimize button which you can click now. It catches any oversights or lacking data and advises you on what to do.

If you are filing with a spouse who has less income, some of your deductions can be transferred to him or her if that saves you money. This online tax return software optimizes your taxes by doing this for you!

With Wealthsimple, the dilemma of how to do taxes online in Canada becomes so much less.

CRA My Account

Did you know that the CRA has a tool that will make filing your taxes online through Wealthsimple Tax much easier? This tool will file your T4 or T4e online for you. It's called CRA My Account. You can sign up for it using a sign-in partner which is usually a bank or financial services institution.

Once you have a CRA My Account number, the information from your T4 or T4e is filled in on the Wealthsimple Tax online form. It even fills in information about the RRSPs you have on record through a financial institution! All you have to do is complete the other parts about donations and any other deductions you may have.

Summary

The Wealthsimple Tax software gives you an ongoing summary on the left-hand side of the screen as you enter your information. You may have a Refund (Yay, you!) or you may owe some money. When you have completed entering your information, you'll get a breakdown of your tax return.

What is really cool is that if the deadline hasn't arrived yet, you can still purchase more RRSPs if you do owe money and update the information and get your total to $0 or better!

Using Wealthsimple Tax software as soon as you get your tax slips and entering the data as you go will make the task of filing your taxes online so much easier! And you can save money by ensuring you do get a refund!

Submitting Your Tax Return

Some people like to see their taxes printed out in paper format. You can do that by downloading a copy of your return. You can also save this as a digital file if you like. Now that you have an account with Wealthsimple, this information is never lost but it's still best to keep a copy.

Now click Submit.

All the information you entered is now sent through CRA's NETFILE transmission service and you can expect to get your refund within 8-10 days of filing! Of course, that is only true if you have provided your direct deposit information to the CRA. Otherwise, it will take longer since getting cheques by mail is always a longer process.

The Reviews

Where to Download

PC Based

Cost

Rating

Reviews

Developer

Downloaded Count

Name

iOS | Android

Yes - Online

Free

none yet (new app)

none yet (new app)

Simple Tax Software Inc.

500+

Wealthsimple Tax

Wealthsimple has a 100% accuracy guarantee that if there is an error in your return due to a software problem, they will reimburse you.

They also guarantee a maximum refund. If you decide to test another software program for filing tax returns online and find that they give you a better return, they'll refund any excess payments you made. They are that sure of their software!

Wealthsimple Tax gets high reviews from everybody. Moneysense says 'Wealthsimple Tax appears to offer the largest suite of features and the most intuitive interface'.

Greedyrates Review says 'Wealthsimple Tax exists to provide Canadians with an easy, secure, and most importantly, affordable means to file taxes'. Walletbrain says 'the software makes it incredibly easy and quick to file taxes for free'.

These are the online reviews by sources that evaluate financial services in a professional capacity.

Reviews from individuals are highly positive as well. Many users have switched from other tax filing software programs to Wealthsimple and love its simplicity, rave about its customer services or enthuse about its speed. First-time users who never knew how to file taxes can't believe they were dreading having to do it!

Are you looking for more information on taxes, banking, mortgages or insurance in Canada? Insurdinary has the answers. Visit our blog or ask for a quote today!