By 2022, experts predict that the market size of fintech will reach $310 billion. Why? Droves of people are turning to new technology that makes financial decisions and management more accessible and convenient.

Wealthsimple is a huge part of this movement. This "robo-advisor" is an online platform that allows you to learn about and manage investing, trade, assets, taxes, and more. Heard the term "robo-advisor" and want more information? Be sure to bookmark our share worthy piece on the topic.

So, what exactly is Wealthsimple, how can you use it, and what can it do to benefit your financial standing? In this review, we'll explain the platform in depth and talk about why so many people are turning to this fintech product for financial advice and management.

Disclaimer:

The content in this article or page is for informational purposes only. While we only conduct the most thorough research and evaluations, and update our content continuously, we cannot guarantee 100% accuracy of the details shown. Users may choose to visit the actual company website for more information.

What Is Wealthsimple?

In recent years, increasing numbers of people are realizing how little they really know about managing their money. Younger generations have been getting interested in stocks and learning about trading. As the gig economy grows, larger numbers of people are requiring special tax advice.

The founders of Wealthsimple felt this shift in culture. They decided to release a comprehensive platform that answered these pain points.

When they first started, Wealthsimple aimed to provide simple investing for beginners. They offered services without the usual fees and restrictions of traditional investment management. The platform's aim was to invest users' money for them.

Wealthsimple offers automatic rebalancing and reinvesting dividends. All this is done while keeping an eye on tax implications. This top-of-the-line technology brought advanced investing services to the common people.

Wealthsimple invests users' money in diversified portfolios with low-cost index funds. As a result, they take away the tedious and time-consuming tasks that make investing inaccessible to most. Anyone can benefit from services that were only available to the ultra rich population.

Wealthsimple also offers financial advisors around the clock. You can talk to them at any time with questions or concerns.

As Wealthsimple took off, developers added other ways to reach financial goals. There are now several different services within the platform. This includes high-interest savings and tax assistance.

How Does Wealthsimple Make Money?

While Wealthsimple provides high value products that can help anyone reach their financial goals, they have to pull in a profit somewhere to keep running. To offer these products, Wealthsimple charges advisory fees that are pricier than most of the competition.

Wealthsimple charges between 0.4% and 0.5% for their advisory fees. Users will want to consider how much money they intend to make and how invested they'll be in the platform before they start paying such high fees.

In exchange for high advisory fees, there are no account minimums or fees. The deal gets better with the more money you invest through the platform. For example, certain support and strategies are only available to users with accounts over $100,000.

With that large of a balance, you can get:

In other words, Wealthsimple will work hard to make a profit, but will reward you for being more engaged with the platform.

How to Use Wealthsimple

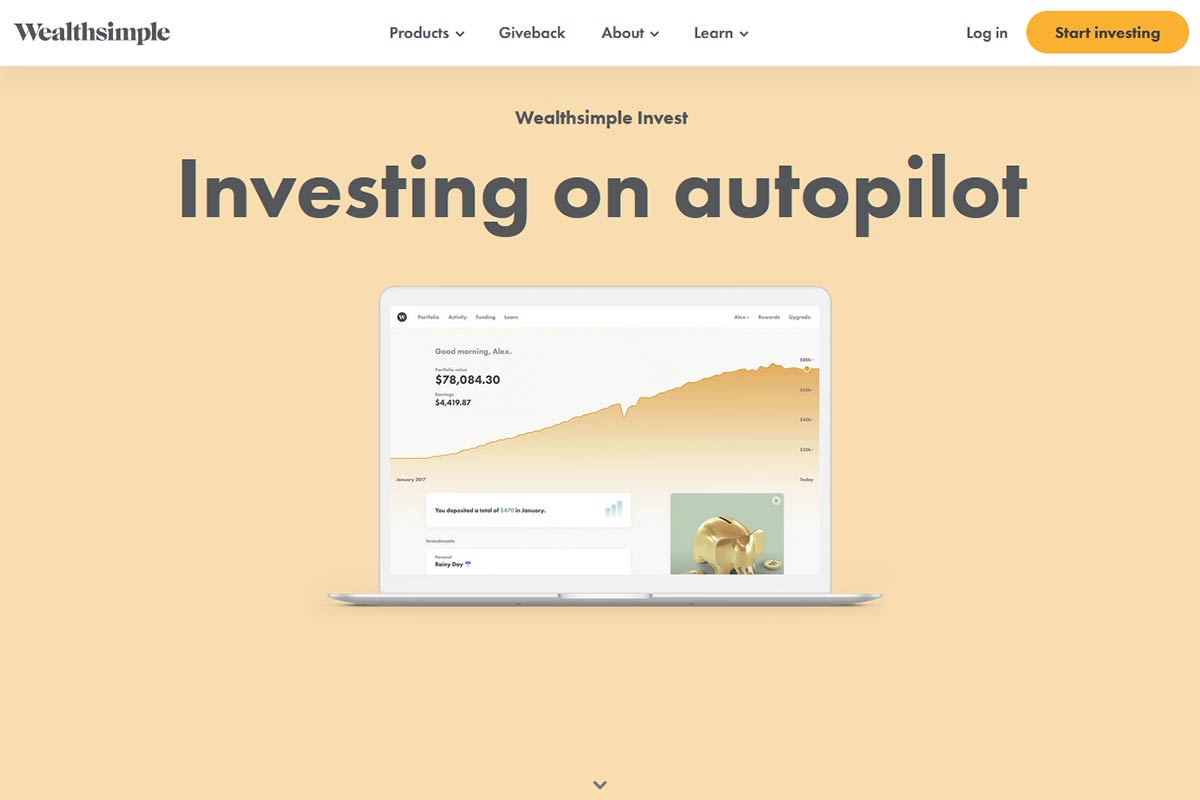

The point of Wealthsimple is "investing on autopilot," so there isn't much to say about manually using the platform. To begin, you'll have to sign up for an account and provide your financial and tax information. Once you're registered, you can begin telling Wealthsimple about your goals and begin to follow advice on how to go about reaching them.

You can choose which services to start with, such as storing your money in their high-interest savings account and picking portfolios you'd like to invest in. Once you've set up your account and goals, you sit back and watch Wealthsimple's AI take over.

You'll still be full in control, but you won't have to check in on stocks and trade all day every day. If you ever have questions, you have 24/7 access to advisors through the platform. It's a win-win for everyone.

Wealthsimple Invest Review

Wealthsimple Invest is the foundational service for the company. This service is where Wealthsimple shines because of its great investment options and AI-driven management.

Portfolio Choices

Wealthsimple offers five portfolios. You will be able to choose according to risk preference and goals. The five portfolios are:

- Conservative

- Balanced

- Growth

- SRI

- Halal

For example, you can choose a portfolio that is low risk (Conservative), medium risk (Balanced), or high risk (Growth). You can also choose portfolios based on whether you need Halal investment. Finally, you can decide to use socially responsible investment options.

The SRI and Halal portfolio options have made Wealthsimple very popular. Social responsibility experts and Shariah-law scholars ensure your investments meet your standards.

These portfolios use six different ETFs that track company's social efforts. This includes adherence to environmental impact standards, social regulations, and corporate governance criteria. All controversial companies involved in tobacco, fuels, and weaponry are removed from portfolios.

For SRI portfolios, experts screen companies for their track records with socially responsible values. This include carbon-emissions and diversity.

Great Accessibility

Wealthsimple wants to bring investing to the people. That's why they offer an account minimum of $0 and no extra fees. You can use automatic deposits, transfers, rebalancing, and dividend reinvestment for no cost.

Wealthsimple's basic service offers tons of extras that keep growing. They offer free portfolio reviews and high-interest savings accounts. They also offer a roundup feature that invests your spare change automatically.

Wealthsimple even offers investments in fractional shares. More expensive stocks are now accessible to people who don't have the full amount.

You don't even need any prior experience or knowledge about investing. Wealthsimple is a simple platform that asks you about your needs and guides your financial decisions. The pricing is simple, and the customer service is impeccable.

On top of it all, Wealthsimple strives to be transparent. They offer information about all their fees and requirements. You can find these through their impressive Help Center.

Robotic Management with Human Help

Wealthsimple allows AI to make informed decisions that have repeatedly beat out human investing experts. At the same time, the platform offers human help around the clock for all your financial needs. You'll always have access to a full team of financial planners, regardless of the amount of money you have in your account.

You'll have email and phone access to advisors. You can discuss you investing progress, portfolio diversity, tax planning, cash-flow analyses, and even your retirement planning.

For those who are skeptical, Wealthsimple is absolutely a legitimate company and investment management service that you can trust.

Some Downsides

Wealthsimple is user-friendly, simple, and works hard to bring investing to the people. On the other hand, they fall short in a few categories that might turn you away.

One, as previously addressed, is their high account management fees. The structure of Wealthsimple is to reward you for investing more money, so it's more beneficial to invest on the platform with $100,000 or more. For comparison, Wealthsimple's account management fees double those of other big name investment management companies like TD Ameritrade and Wealthfront.

In addition, Wealthsimple's platform doesn't have a lot of the personal financial tools that other companies offer. While you can speak to advisors around the clock for free, you won't have a lot of access to calculators, educational resources, and planning tools.

Simplicity is what Wealthsimple is going for, so if you would rather speak to a person anyway, that's fine!

How Does Wealthsimple Invest My Money?

Once you choose your financial goals, Wealthsimple goes on autopilot. You can set up auto-deposits and manage your accounts no matter where you are.

Wealthsimple takes all the dividends you earn and instantly reinvests them so that they continue to make you money. You'll also benefit from automatic rebalancing, which will alter your portfolio as the landscape changes so that it is also doing the best to benefit you.

Is My Money Safe With Wealthsimple?

Wealthsimple goes through extreme measures to ensure your money is safe. They guarantee that everything is encrypted with the best technology available and require two-factor authentication.

You accounts are also CIPF protected, so you'll never have to worry about losing your money from insolvency. The company itself is also backed by $380 million in investments from the world's top financial institutions.

Wealthsimple Cash Review

The leaders of Wealthsimple saw how popular digital wallets like PayPal and Snapcash became. To get involved in this sector of fintech, Wealthsimple added Wealthsimple Cash. Through this cash app, you can send and receive cash instantly.

To start sending and receiving money, you'll have to acquire a unique handle. You will be able to make transactions through your handle by typing in other people's handles.

These transactions are combined with chat rooms, where you can send messages about transactions easily with your contacts. You can even split a bill!

With Wealthsimple Cash, there are no monthly account fees or fees for deposits and withdrawals. You won't lose any money through transactions, which is a better deal than most other cash apps.

In addition, you can feel secure that your money is CDIC insured and the app requires two-factor authentication. You can even set your privacy settings so only people you know can find you.

Wealthsimple offers a Visa card that allows you access to your money through Wealthsimple Cash. Wealthsimple Cash isn't technically a bank account, but it offers everything that a regular bank does. You can do all your daily banking and transactions using the platform.

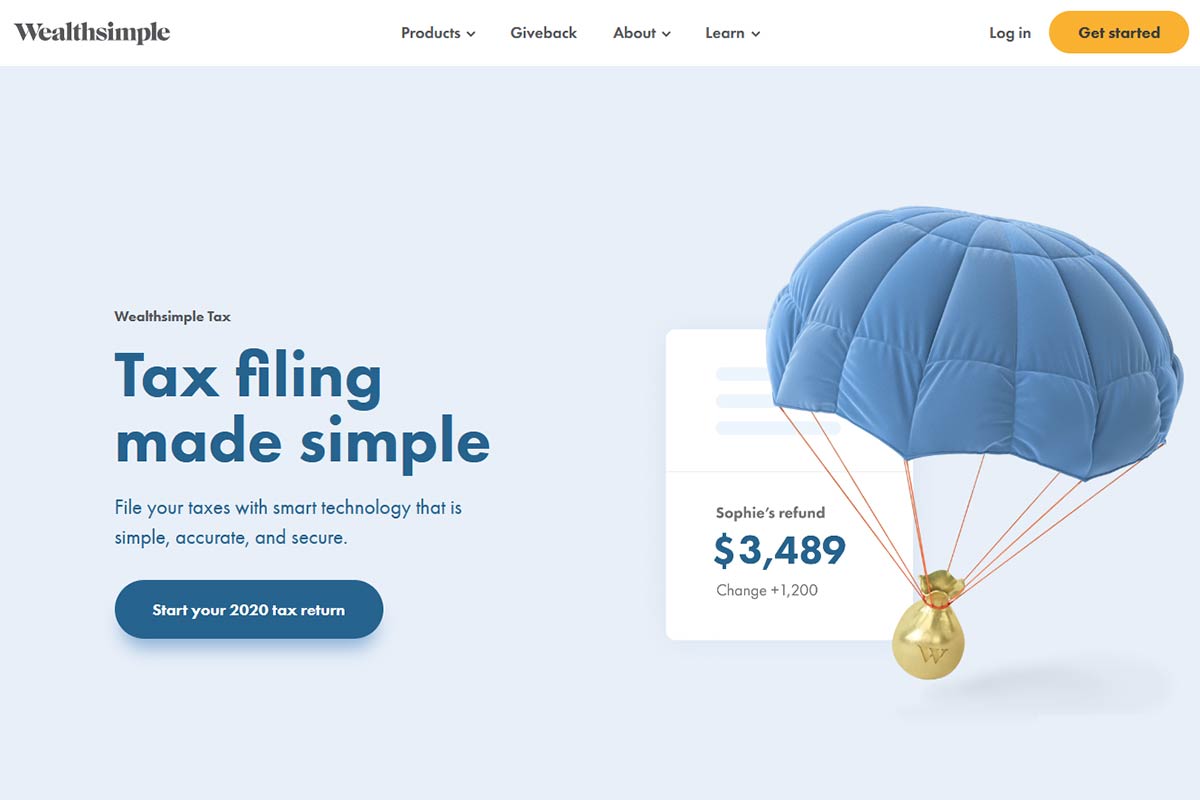

Wealthsimple Tax Review

Many people's taxes have been altered greatly by economic changes. A rise in the gig economy and the occurrence of federal relief has complicated taxes. Wealthsimple Tax is the tax software that helps those working from home and freelancing figure out their taxes.

Wealthsimple guarantees the maximum refund according to the regulation of the Canadian Revenue Agency. This tax platform is Revenue Quebec and CRA certified.

This platform even offers audit support. If the CRA returns your tax filing with an audit notice, Wealthsimple will help users understand and move forward with the appropriate actions.

Wealthsimple auto-fills your return with tax slips you import and searches the documents by keywords. You'll be able to see your estimated return as you go, and you can make any changes to reach your return's full potential.

Just like Wealthsimple's other services, Wealthsimple Tax offers teams of human experts you can talk to about tax questions.

Wealthsimple ensures that your information and finances are secure by using top-notch encryption and two-factor authentication.

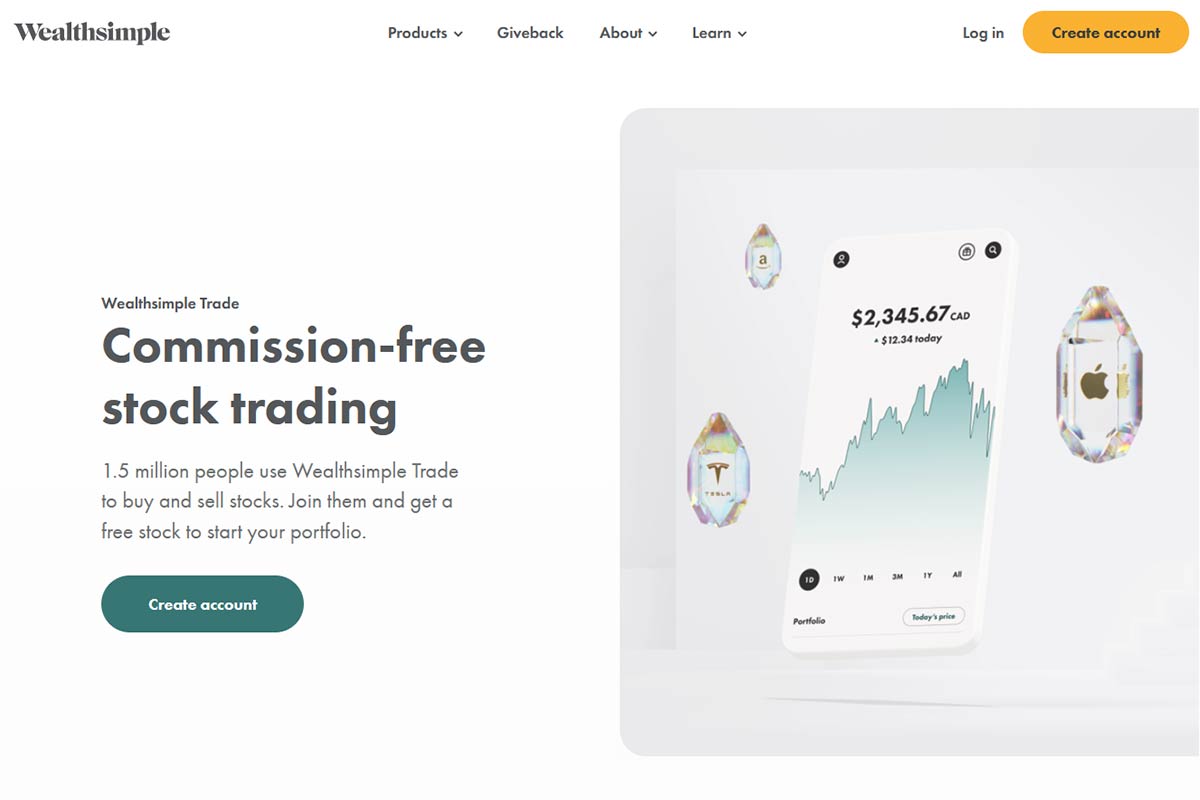

Wealthsimple Trade Review

Wealthsimple Trade offers commission-free stock trading, which is huge for the 1.5 million people that utilize the service. The company explains that they can offer $0 commission because they allow their state-of-the-art technology to do all the heavy lifting.

People love Wealthsimple Trade because of it's option to invest in fractional shares. It's also great because it allows you to deposit money instantly without fees. For those who are interested in cryptocurrency, Wealthsimple offers crypto investments, too.

When you join, you even get a free stock to start.

For premium clients, Wealthsimple offers real-time stock prices at any time, so you can have accurate market data whenever you request it.

Wealthsimple Trade offers three plans. If you're just someone who wants to get started with investment with a taxable account, you can use the personal plan. If you'd like a savings account that will grow your money tax-free, you can try the TFSA account. Finally, you can invest to save for retirement through the RRSP account.

The great thing about Wealthsimple is that you can have a completely free account if you're just looking to start your portfolio. If you're looking for something more flexible and advanced, you only have to pay $3 a month for the premium account.

However, critics complain that trading options are limited because you can only trade stocks and ETS on Canadian and U.S. exchanges.

Wealthsimple Stock

Wealthsimple recently refocused the Canadian market by selling its US book of business to Betterment in March 2021. Leaders of the startup continue to contemplate whether they should pursue of charter banking license.

In May, Wealthsimple announced a $5 billion valuation followed by a $750 million round. Experts are waiting eagerly to see if Wealthsimple will go public soon.

Wealthsimple App

The Wealthsimple app is a beautifully designed application that is meant specifically for beginners. It is simple, clean, and clear so that every user can explore their options and make informed decisions.

Some critics argue that the Wealthsimple app is too simple because it doesn't provide all the resources that other companies do. However, the mission of Wealthsimple is to only provide what's absolutely necessary without overcomplicating finances.

Wealthsimple is certainly legit. Over 1.5 million people have used the Wealthsimple platform to take control of their finances.

Wealthsimple Login

Wealthsimple makes it easy to get started, boasting a registration time of 5 minutes. All you need for login is an email address and password and to identify your where you live. You must live in the UK or Canada to register.

Once you're in, you will be asked a series of questions to set up your profile, link your accounts, and identify your financial goals. The rest is as easy as sitting back and watching your money grow.

Make Informed Financial Decisions

Taking charge of your finances is the first step to securing your future. With great educational resources and experts on your side, you can achieve all your goals and more. Wealthsimple certainly makes investing, taxes, and money management accessible to all.

Insurdinary loves Wealthsimple's mission. That's why we offer comparison platforms for everyone to find the best deals on insurance, mortgages, and banking. That way, everyone can make the best financial decisions for themselves and their families.

Check out our banking comparison platform today!