Are you looking for something new to add to your portfolio? It's always good to diversify your investments. But, the key is to find new investment vehicles that are going to strengthen your portfolio, not weaken its performance.

With gold, bonds, commodities, ETF funds, and all of the other investment vehicles available to Canadian investors, it can be challenging to decide which investment class is right for you. In fact, it can be downright overwhelming at times. This is why we'd like to make a case for investing in Canadian utilities stock.

The key to smart investing is to invest in things that you can easily understand. Canadian utilities stock is something that directly affects the general public on a daily basis. It's not difficult to understand what the companies do, what services they provide, and how they make their money.

It's easy to invest in something that you can wrap your head around. Something as straightforward as utilities stock. And, since it's a simple concept, it's also easy to trust the stocks' performance.

In today's article, we're going to get you even more familiar with Canadian utilities stock. By the end of this article, you'll feel extremely comfortable adding these assets to your portfolio.

A Little More on Familiarity

The reason that we say you're already familiar with Canadian utilities stock is that it involves companies you use every day. More specifically, energy and utility companies.

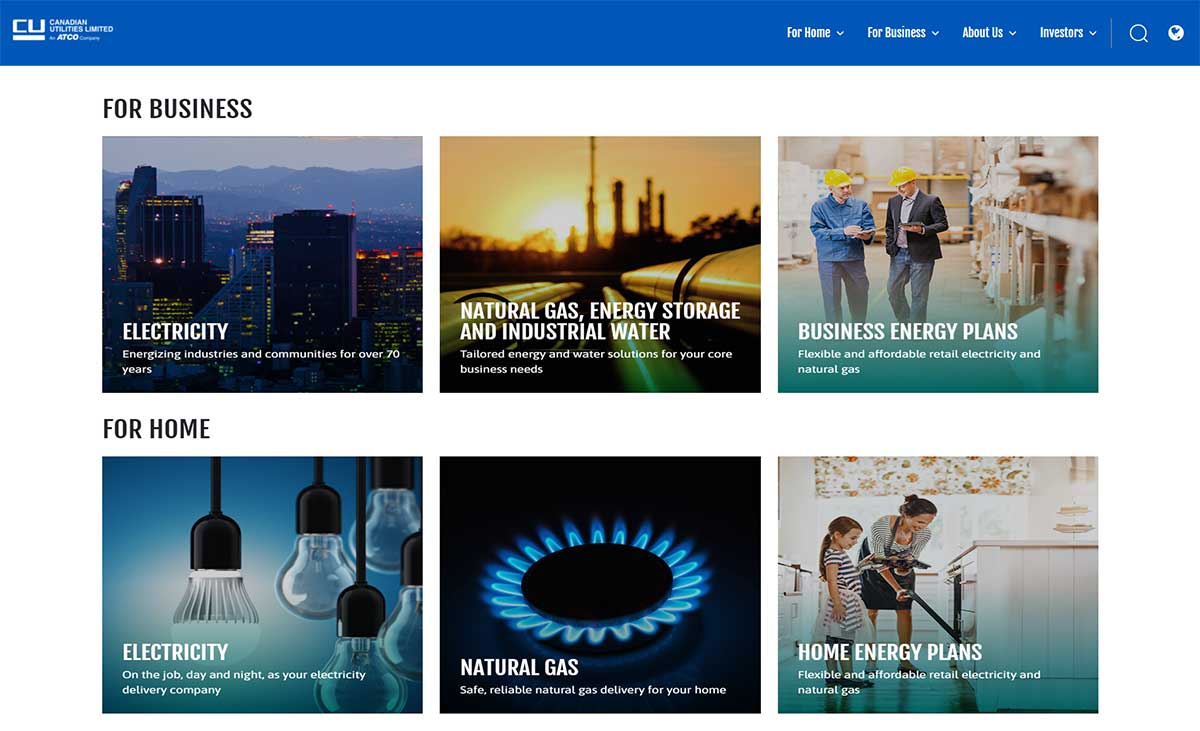

Canadian Utilities Ltd.

CUL (Canadian Utilities Limited) is a member of the ATCO Group Of Companies. The organization is a Canada-based operation but operates worldwide and boasts assets of roughly $7.3 billion. Within the three main business divisions, natural gas, electricity transmission and distribution, over 6500 people are employed. The global enterprises consist of energy services, logistics and technology.

Canadian Utilities Limited: Stock, Price and Performance

Canadian Utilities Limited stock is stock in a subsidiary company of a company called ATCO. ATCO provides electricity and gas services. Their headquarters is in Alberta, Canada but the company operates in several different countries.

In addition to Canada, ATCO does work in Australia, the United States, and Mexico. Their main focus is electricity, gas, pipelines and liquid energy, and retail energy.

To help you understand more about Canadian Utilities Ltd., let answer some commonly asked question about its stock, price and performance.

Is It A Good Dividend Stock?

The annual dividend which Canadian Utilities pays is $1.75 per share and presently has a dividend yield of 5.04%. CU is a leading dividend payer as it yields higher than 75% of all dividend paying stocks. Payout ratios which exceed 75% are not ideal as they may not be sustainable.

What Price Target Have Analysts Set?

According to 9 Wall Street analysts, the forecast for Canadian Utilities stocks forecast ranges from $32-$39 (CDN dollars) Within the next twelve months, the share price is projected to reach $37.11 - which calls for a 6% upswing from its current position.

Market Performance

Overall, CU stock is performing well. Over the past year, the stock has seen almost a 20% growth in stock price. For the stock price to go up, the company must be performing well. That means the health of the company is good news for investors.

nvestors in the stock have also seen an increase in dividend yield. The Canadian utilities dividend investors receive has grown from 4.90% to 4.92%. That increase doesn't seem like much, but if it continues to compound over time, this is a stock that will help strengthen investors' portfolios for the long haul.

Does ATCO Own Canadian Utilities?

When you're investing in a stock, it's always good to do some background research. You want to be able to trace ownership and management trends within a company all the way back up the "chain of command".

You're putting your hard-earned money into these stocks, so it makes sense for you to get an idea of who is at the helm of some of these companies. It's easy to get wrapped up in the P/E ratio and balance sheets of different companies. That's called your technical analysis of a stock.

But, people are very much a part of the equation that's hard to ignore. This is why it makes sense to do some research on the non-technical aspects of companies you plan to invest in. This type of analysis is fundamental analysis.

In the case of Canadian utilities stock, if you trace back the ownership of the company you'll find that ATCO does indeed own the company. We see proof of this in the way investment websites refer to Canadian Utilities. When the company is mentioned, it's almost always mentioned as "a subsidiary" of ATCO.

They also refer to ATCO as the "holding company" for Canadian utilities. This is usually a good indication that two companies share management and corporate structure.

Canadian Utilities Companies

Although ATCO is the parent company for Canadian utilities limited stock, the stock actually involves a wide variety of companies. All of these companies are partners and/or subsidiaries of ATCO, but they all affect the performance of your stock. If you're invested in Canadian utilities limited, that is.

Let's explore the list of companies involved down below.

ATCO Electric

First and foremost, we have ATCO electric. This is considered the "parent company" for all of the companies within the Canadian utilities limited stock.

The company originated in 1947 under the management of the founder, Don Southern. As early as the 1960s, ATCO already began to operate across a large part of North America and began to have operations in Australia.

From these humble beginnings, the company has now grown to service approximately 67% of the province of Alberta with electricity and other utilities. In addition, the company also serves communities in the Yukon and Northwest Territories. ATCO does this through a handful of subsidiaries that serve in those areas.

ATCO Electric, as we speak, is trading at $34.10 and is showing a -0.076% net change in the market.

Canadian Utilities

Now, this is where things can get a little tricky. Canadian Utilities Limited is the name of the ETF which holds stock in all of the companies we're discussing here today. However, within that ETF, Canadian Utilities is also a subsidiary company of ATCO.

This particular company is responsible for a portion of ATCO's water and gas utilities arm. It's always great to see strong family values in a company. And ATCO has done exactly that as evidenced by the appointment of Nancy Southern as Canadian Utilities CEO. The company is also one of the younger companies in the group as it was founded in the Spring of 1999.

Currently, their individual stock is trading at $25 and has shown 0% net change in the market so far today.

ATCO Real Estate Holdings

This subsidiary of ATCO primarily deals with the acquisition of land and other real estate assets. This may be new facilities for the company or new raw land acquisitions for the construction of power lines and pipelines.

According to Canadian records, this particular company was incorporated in 1970. This would mean, based on what we know, that this was one of the first companies formed in the ATCO family of subsidiaries. When your business is supplying utilities to the masses throughout North America and Australia, it's only a matter of time before you get involved in the real estate game.

Power grids and pipelines need somewhere to go. As a result, power companies usually end up getting involved in the acquisition of various forms of real estate.

ATCO Real Estate Holdings has remained small. The public record shows approximately 50 shareholders as per the latest corporate filings.

ATCO Gas Australia Pty Ltd.

Early on in the company's history, ATCO began to conduct business throughout parts of Australia. One of the companies responsible for this expansion is ATCO Gas Australia.

The company is located in Western Australia and its primary focus is distributing natural gas to the area. The company has approximately 350 employees and is responsible for $132.39 million in sales.

The company is also responsible for covering a large portion of Australia's power grid. Their gas networks cover 14,000km and provide natural gas, as well as liquid propane gas (LPG), to 750,000 Australian residents.

ATCO Australia Pty Ltd.

ATCO Australia is the "parent company" of ATCO's Australian arm of operations. They are headquartered in Perth and have serviced Australia's gas and power needs for over twenty years.

In addition to electricity and utilities, the company also focuses on structures and logistics. Through this area of the company, ATCO works to provide workforce housing to its people on the ground in the local area.

ATCO also conducts some business in the commercial real estate space, infrastructure development, industrial water solutions, and retail energy sales.

ATCO Australia is a sizeable company boasting 7,000 employees and $22 billion in assets.

Currently, ATCO Ltd. is trading in the Australian market at $42.93 and is showing a -0.21% net change.

ATCO Mexico

ATCO Mexico is actually one of ATCO's more interesting subsidiary companies. Yes, they focus on providing electricity and other utilities to the area, but they also put a big focus on the development side of the business.

ATCO Mexico is the company that is responsible for a lot of ATCO's pipeline work, as well as real estate development.

In fact, just last year, ATCO saw tremendous opportunity in Mexico for its pre-fabricated housing products. The company is focused on providing housing for its workers on the ground as well as other members of the community.

ATCO also sees an opportunity in expanding the education and infrastructure of the local area in Mexico. From Mexico, ATCO also foresees its operation expanding to other nearby countries like Guatemala, Colombia, Ecuador, and the Bahamas.

Partnering with Mexico

The company is working with the Mexican government to help foster expansion into the South of Mexico, as well as areas in the Baja of California. Monterrey, Dos Bacos, Chihuahua, and Baja California are all areas that are on the company's radar.

ATCO feels like working with the government to expand infrastructure into these areas will present great opportunities for workforce housing and jobs. The company has a track record of being able to erect and sustain workforce housing camps of over 3,000 homes. What's even more impressive is the company's reputation for erecting these developments in areas that have been deemed "inhospitable".

In Mexico, the ATCO team is working closely with the government to solve problems that are important to the local people. In the center of the country, ATCO is focusing on education and health. In Northern Mexico, the company is putting its efforts toward exploratory mining.

And in the South of Mexico, there is a lot of potential. Because the area is still relatively "untouched," ATCO executives see a lot of opportunity in every niche. They're even considering an expansion into tourism in certain areas of the country.

Source Energy, Ltd.

Source Energy is the first company in Canada to offer unit-train capable terminals. This cutting-edge technology has allowed them to revolutionize every step of their supply chain. As a result, the company is now a leader in the oil and natural gas sector.

Their innovations are helping to reshape how the company will continue to use natural resources in the future. The company continues to rise to meet Canada's oil and gas demands. Their innovations within the industry also continue to make them the most resourceful when it comes to new energy solutions.

ATCO Electric Yukon

One of the things that put ATCO on the map is providing electricity to communities within the Yukon. The Yukon is known for some notoriously harsh terrain. The act of getting power out there alone is no small task.

But, leave it to ATCO to not only provide power but continue to provide stellar customer service to those power lines and grids as well.

The company serves most of the communities in Yukon and is headquartered out of the City of Whitehorse. In addition to the communities of the Yukon, ATCO Electric Yukon also serves the community of Lower Post, British Columbia.

ATCO's service area in the territory is a small, but tight-knit community. The Yukon arm of the company currently services 19,000 customers across 19 different Yukon communities.

ATCO's Yukon arm is also focused on giving back to the local area. Their philosophy is "We all live, work, and play in the territory." As a result, ATCO puts a lot of passion and effort behind supporting local social, economic, and environmental initiatives throughout the Yukon.

Unwrapping Canadian Utilities

There you have our in-depth breakdown of Canadian utilities stock and the ATCO family of companies. The company boasts a strong history of service over a wide geographic area. They also seem to have upstanding, family values in-house.

In our opinion, it's all of the things you would want from a stable, long-term hold investment vehicle. Add to that the fact that they're in an industry that's not going anywhere anytime soon, and you've got yourself a winner. It doesn't hurt that many of the ATCO companies are leading the way for innovation in their respective sectors, as well.

The Insurdinary team is here to help you in any way we can. If you're an investor interested in dental, health, or life insurance products, reach out to us any time. We are more than happy to help you answer any questions you have to get you the coverage you need to focus your time and energy where it matters: your investment portfolio.