What do you think of when you hear the word investing? Do you think of rich men in suits, sitting around a table discussing a business deal? Investing doesn't have to be that intimidating.

With the Oaken GICs, you can start investing with as little as $1,000.

What Is a GIC?

GIC stands for a guaranteed investment certificate, and it is an investment available across Canada. You will invest a certain amount of money in the certificate in exchange for a guaranteed return on that money.

Interest will accumulate during the duration of the investment. Once you reach your GIC's maturity date, you can receive the interest you earned and take out the money you put in.

Even if the bank where you get the GIC closes, you are insured up to $100,000 by the Canadian Deposit Insurance Corporation (CDIC).

How GIC Rates Work

GIC rates can differ between institutions, but mostly depend on their maturity date. Longer terms generally result in higher interest rates.

However, how often you receive interest payments may also affect your rate. A GIC with a monthly interest payments will have a lower return on investment than one with an annual payout.

While the amount of money you invest won't change your rate, it will affect how much you earn.

The GIC can provide some extra security to your investment portfolio. However, you will need to invest your money in a longer-term GIC to get the highest return on investment.

Oaken GIC Rates

Oaken Financial GIC rates are similar to other Canadian financial institutions. However, the rates are some of the best in Canada.

Only a few other banks, such as People's Trust or Achieva Financial, have similar or better GIC rates. So if you're looking for a good place to get a GIC, you can't go wrong with Oaken Financial.

But first, consider a breakdown of their GIC rates.

Long-Term GIC Rates

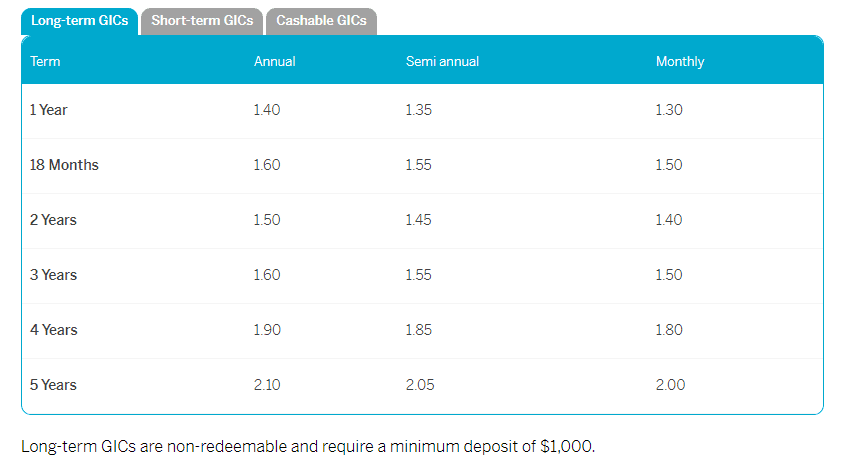

Oaken Financial classifies long-term GICs as those that last at least one year. The institution has GICs with terms that range from one to five years, and the minimum deposit is $1,000.

Each option lets you receive interest annually, semi-annually, or monthly. Annual rates are higher than the others, even for GICs with the same fixed term.

Rates on a one-year GIC are 1.3% for monthly, 1.35% for semi-annual, and 1.4% for annual payments. The 18-month GIC has an even higher rate of 1.5% to 1.6%, depending on the frequency of interest payments.

If you get a two-year GIC, you can earn 1.4% to 1.5% on your investment. When you invest for three years, you can get the same rates as you would with an 18-month GIC.

You will earn 1.6% to 1.7% on your investment with a 4 year GIC, again, depending on the frequency of interest payments. A five-year GIC has interest rates from 1.7% to 1.8%.

Short-Term GIC Rates

A long-term GIC can be a good option, but it does mean you can't access that money for a long time. If you don't want to tie up your money for long, you can get a short-term GIC.

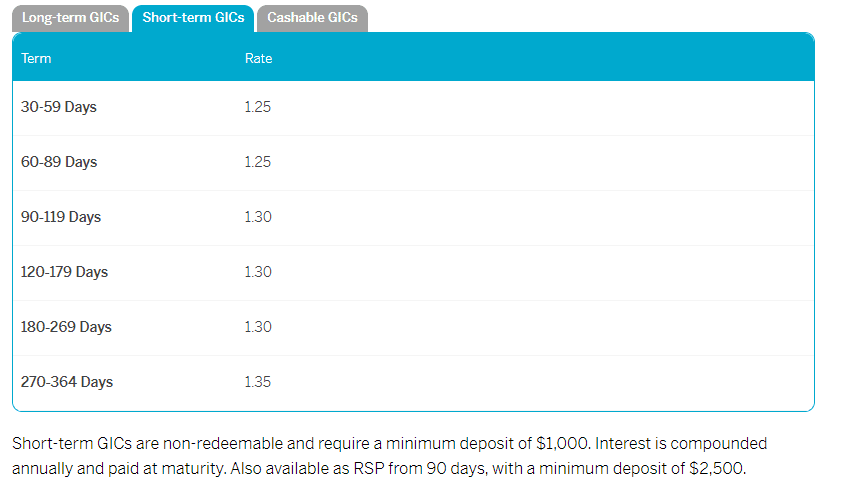

Short-term GICs can be for 30 to 364 days, and the interest rates depend on that length. If your GIC is 30 to 59 or 60 to 89 days, you can earn 1.25% in interest.

At 90 to 179 days, you can earn 1.3% in interest.

If you invest in a GIC for 180 to 269 days, you can earn 1.3% on your investment as well. When you invest for 270 to 364 days, you'll earn 1.35% on your investment.

With any short-term GIC, Oaken Financial requires that you deposit at least $1,000. You will get your interest payment when your GIC matures.

Cashable GIC Rates

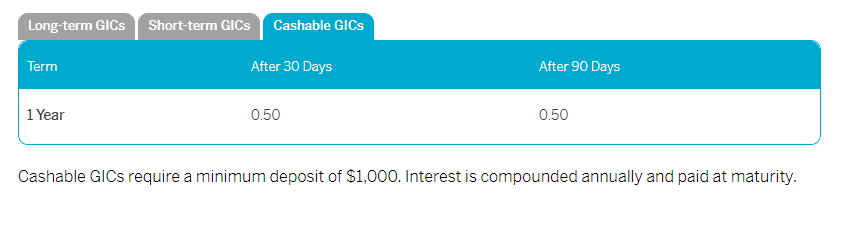

If you want a longer-term investment but may want access to your money, you can consider a cashable GIC from Oaken Financial. Unlike other GICs, you'll have access to your money at any point after a penalty period.

You can withdraw your money after 30 or 90 days. The interest rate for this GIC at Oaken Financial is 0.50%, and you'll need to deposit at least $1,000.

A cashable GIC can be a good way to take advantage of higher interest rates compared to a traditional savings accounts while still being able to access your money. They're great if you want extra security from your investment.

How to Choose a GIC

As you compare Oaken Financial GIC rates, you should consider what GIC is best for your situation. While the five-year interest rates are the best by far, you may not want to lock in your money for that long.

Consider the following factors when looking for the best GIC for your situation.

Durations Available

First, you should consider how soon you may need to access your funds. If you've never invested before, you may want to start with a short-term GIC, to dip your toes.

On the other hand, if you're risk-averse and want to maximize your interest rate, a five-year GIC might be best for you.

Getting a GIC will also lock in that interest rate for the entire period. If interest rates decrease, you won't have to worry about potentially earning less interest.

If your GIC matures and interest rates have increased, you can renew your GIC at the new rate.

Access to Your Money

Consider if you may need access to your money before the GIC matures. If so, a cashable GIC would be more suitable.

You'll still need to wait for a month or so before you can withdraw. But after that period, you can take out money from your GIC without any penalties.

You can also get a standard one-year GIC to get a higher interest rate. You'll have to wait the full year to get your money.

Savings Goals

Another thing to think about is your savings goals. A GIC is an excellent investment if you're looking to save up for a major purchase because it's return is guaranteed.

If you're saving up to buy a house in a few years, you may not need that money soon. So you could take advantage of the higher Oaken Financial rates with a longer GIC.

For smaller purchases consider this: if you know you’ll need to replace your laptop in a year, you could invest the money you’re willing to spend on your purchase in a short-term GIC, allowing you to earn interest on it. You could use your profits to buy a better laptop than you originally envisioned, or for any other purposes.

What About a Savings Account?

If your main goal is to save money, you may wonder if a GIC is really better than a traditional savings account.

If you already have plenty of money in your savings, you could invest the rest to earn interest on your funds. However, you should always keep at least three months' worth of living expenses in case of an emergency.

While Oaken rates for savings accounts are good, they aren't as good as the GIC rates. So as soon as you feel comfortable with your savings balance, it would be advisable to invest a portion of your savings in a GIC if you'd a low-risk way to increase your interest earnings.

How Much Should You Invest in a GIC?

As long as you meet the minimum investment requirement, you can put as much money in a GIC as you want. Oaken Financial offers a GIC calculator you can use to see how much you can earn from a certain balance and term length.

You can use the calculator to determine how much to invest to meet your goals.

Or if you have an amount in mind that you want to invest, you can see how much you can earn depending on which GIC you invest in from a few months to five years.

Start Investing Today

If you want to start investing but are afraid of risk, consider a GIC. Oaken GIC rates are among the best and provide a guaranteed return.

Do you need more information about banking? Check out the best bank accounts in Canada.