Most people have heard of Loan Connect. However, you might wonder if this loan search engine service is the best way to meet your personal loan needs.

Like many consumers around the world, Canadian citizens juggle billions of dollars in debt. Accordingly, a large number of Canadians live paycheque to paycheque. With this in mind, you may find that there are occasions where you need to access cash fast.

However, it can prove challenging to secure a traditional bank loan. Fortunately, a service such as Loan Connect can help you to find more flexible borrowing terms.

Disclaimer:

All, or some of the products featured on this page are from our affiliated partners who may compensate us for actions and or sales completed as a result of the user navigating the links or images within the content. How we present the information may be influenced by that, but it in no way impacts the quality and accuracy of the research we have conducted at the time we published the article. Users may choose to visit the actual company website for more information.

Is Loan Connect Legit?

Loan Connect is a reputable Canadian personal loan company. The company’s mission is to provide Canadian residents with easier access to money.

The company has an A+ rating with the Better Business Bureau (BBB). Loan Connect received this rating in 2018, two years after they started operating in 2016.

As for customer reviews on the BBB and Trustspot websites, Loan Connect is close to five stars. Additionally, customers have provided details regarding the business, saying that customer service was courteous, highly professional, and helpful.

Today, Loan Connect has been in business for around half a decade. Still, the company has yet to earn an official BBB complaint.

The Scoop on Loan Connect

Loan Connect is headquartered a little over two hours southwest of Toronto, but the company offers its service to all Canadians.

Loan Connect acts as a search engine for loans. It can take as little as five minutes for you to find a suitable loan. The company is well known for helping Canadians find competitive loan rates. You can secure a loan for as much as $50,000 and pay as little as 4.6% in interest if you have great credit. However, you can find great loan options through Loan Connect even if you have bad credit.

It can prove challenging to find and secure a loan with damaged credit. Banks, for instance, will typically shy away from offering you a loan if you have a credit score that ranks from poor to fair. For these and other reasons, many Canadian residents turn to Loan Connect when they need to borrow cash.

Loan Connect serves as a middle ground between banks and more expensive borrowing options. What’s more, the service is much faster than applying through a bank. For this reason, Loan Connect is great if you need money in a pinch. With Loan Connect, you’ll find potential lenders in minutes and you will find out if you are qualified for a loan instantly, in many cases.

Loan connect is a free service; lenders pay Loan Connect a fee for referring new borrowers, so its customers do not incur any extra fees.

A Closer Look at Loan Connect Financial Products

Through Loan Connect you can search for different types of loans. These include personal loans, debt consolidation loans, car loans, business loans, and many others. The category of your loan matters because it may impact the amount you can take out and the rate you will get.

There's a variety of reasons why someone would need a loan, but whatever your reason may be, Loan Connect will connect you with the appropriate lender.

Loan Connect Pros & Cons

Pros

- Vast selection of moneylenders

- Interest rates as low as 4.6%

- User-friendly fully online process

- Loans are provided faster than through banks

- No minimum credit score

- High maximum loan amount of $50,000

- Available across Canada

Cons

- Loan type may affect rate or approval

- Based on credit score, loan terms may not be as appealing

- Not affiliated with certain lenders

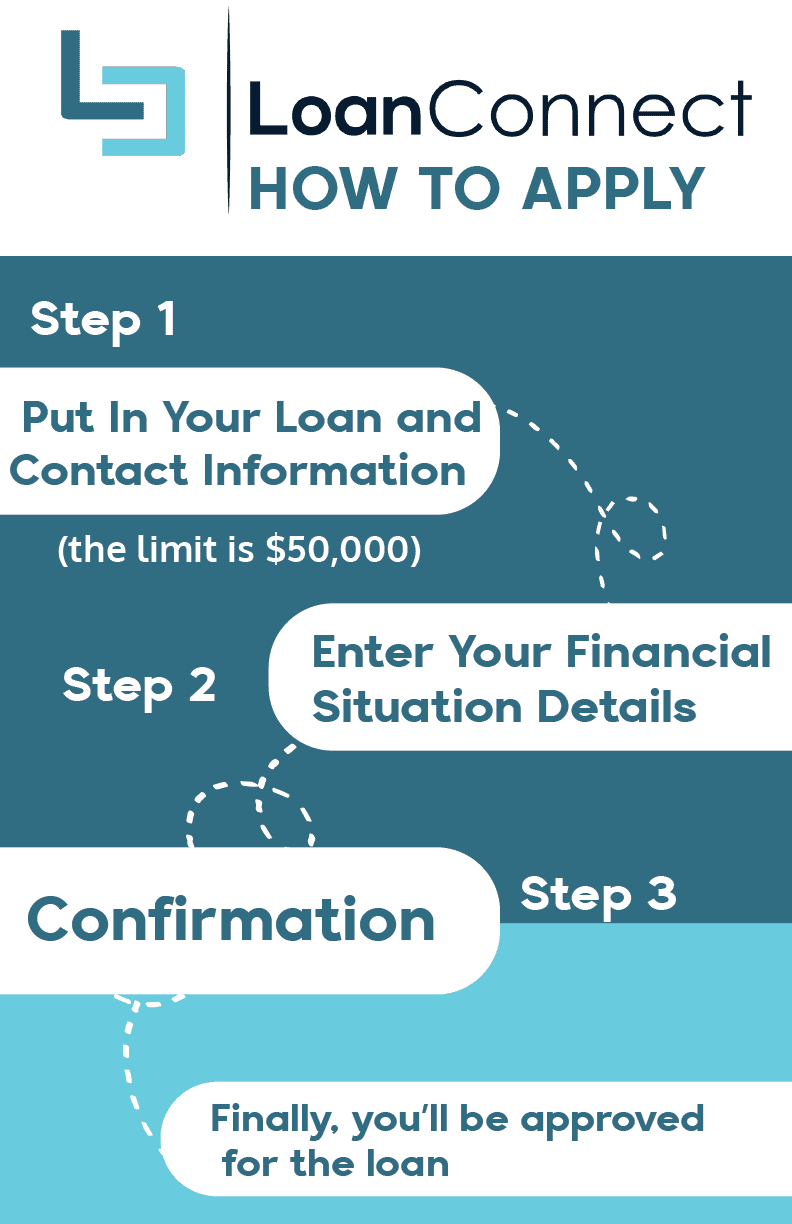

How to Get a Loan through Loan Connect

You must have Canadian residency to use the platform. You must also have reached the majority age in your province. In most instances, lenders will not service your loan if your debt is already over 60% of your earnings.

If the above criteria are met, Loan Connect platform will display your prequalified offers based on information you've provided. It will also show your monthly payments and terms for each offer.

Once you’ve found a suitable loan, you can click on the link to go to the lender’s website. There, you’ll finalize your application.

Once the lender approves your loan, you can receive your funds and as little as 12 hours. Now, you’ll simply have to make the repayments on the loan as agreed.

Learn More about Making the Most of Your Money

Now you know more about using Loan Connect for personal loans. However, there’s so much more to managing your financial health.

Insurdinary is one of Canada’s leading insurance comparison and financial education websites. Here, you can get informed before you get insured. Our website empowers you to make educated decisions about various financial products.

If you want an easy way to compare insurance, please feel free to take advantage of our fast, free quotes.