Imagine you just got a huge raise or bonus from your employer. You don't need the money for bills, but you don't want it to sit in savings, so you decide to invest it.

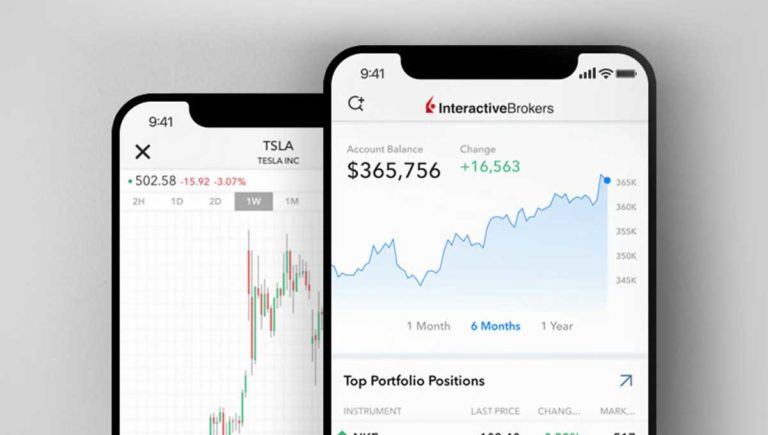

Before you choose where to invest the money, consider Interactive Brokers Canada. It's a great place to diversify your investments and grow your portfolio.

Keep reading to learn more.

Disclaimer:

The content in this article or page is for informational purposes only. While we only conduct the most thorough research and evaluations, and update our content continuously, we cannot guarantee 100% accuracy of the details shown. Users may choose to visit the actual company website for more information.

Interactive Brokers Canada: What Is It?

Interactive Brokers Canada, Inc. is the Canadian member of Interactive Brokers Group. The group allows customers to access trade markets in different countries.

Members can also access over 100 equity and derivatives exchanges. Overall, Interactive Brokers Group processes almost 1 million trades each day.

Interactive Brokers Canada is a Canadian Investor Protection Fund (CIPF) member, meaning it works to protect your investments. If something were to happen to IB Canada, CIPF would help.

What Can I Invest In with Interactive Brokers?

You can use IB Canada to invest in stocks, bonds, options, and future options. Other investments include mutual funds and precious materials.

Forex and warrants are also available through the IB platform. When using the IBKR API or trader workstation, you also have access to combinations, structured products, and inter-commodity spreads.

Having access to that many investments lets you create a diverse portfolio. Another benefit of using Investment Brokers is that Canada isn't the only market open to you.

With Investment Brokers, you can access markets in around 200 countries all over the world. Of course, the list includes Canada, the United States, and the United Kingdom.

There are available countries in North and South America, Europe, Asia, and Africa. Australia, New Zealand, and other countries in the area are also on the list.

Is Interactive Brokers Safe to Use?

Interactive Brokers Canada is safe to use. Because it's a CIPF member, the company covers your account up to $1 million in losses in case IB becomes insolvent.

However, Interactive Brokers also protects consumer accounts as long as the company exists. The company will protect up to $30 million, $1 million of which can be in cash. That coverage protects the market value of all of your investments.

The Securities Investor Protection Corporation (SIPC) and Lloyd's of London provide the protection. SIPC offers the first $500,000 in coverage.

If you max out that coverage, Lloyd's of London can cover the remaining balance for an additional $29.5 million. That way, you can invest without worrying about the security.

While any investment comes with some risk, having that protection is nice. You'll need to consider your risk tolerance so that you can select the best investments for you, and they'll all have the same protection.

What Accounts Can I Open With IB?

Interactive Brokers Canada offers a variety of accounts to suit your needs:

- Individual investor or trader

- Friends and family advisor

- Family office

- Small business

What Are the Fees?

Before you start using Interactive Brokers Canada, consider the fees and commissions you'll need to pay. Look at the breakdown to make sure it will be worth it for your investments, or if you want something with fewer fees.

Commissions

If you choose tiered pricing for stocks, warrants, and ETFs, you'll need to pay at least $1 per order. The maximum payment is 0.5% of the trade value. Other fees depend on your trade volume for the month.

- $0.008 for 300,000 shares or less

- $0.005 for 300,001 to 3 million shares

- $0.004 for 3,000,001 to 20 million shares

- $0.003 for 20,000,001 shares or more

If you choose fixed pricing for stocks, warrants, and ETFs have the same minimum and maximum, and you will pay $0.01 per share. When trading options, you'll have to pay at least $1.50 per order. Commissions range from $1 to $1.25 per share based on the volume.

Margin Rates

Margin rates for IBKR vary based on tiers, which depend on overall volume. Interactive Brokers uses tiers, which can make it hard to calculate margin rates. However, you can look at the tiers to get an idea of them.

- 1.588% for 0 to 140,000

- 1.088% for 140,000 to 1.4 million

- 0.588% for 1.4 million or more

Investments over 140 million may incur a 1% surcharge when you don't arrange financing ahead of time.

Interest Rates

If you leave money in your securities account, you can earn interest on it. While this isn't a fee you have to pay, it can be nice to receive that extra money if you don't know where to invest yet.

The benchmark rate for Canadian investments is 0.088%, so you can use that to calculate your interest. If your balance is greater than $140,000, you will receive the full amount, while lower balances will receive a portion of it.

Other Interactive Brokers Fees

Interactive Brokers charges a variety of other fees that you should know. Then, you can prepare for these costs before you invest.

DTC transfers are also available for deposit or withdrawal. You will need to pay $30 per transaction plus the settlement or rejection fee that the agent charges.

One fantastic benefit of using Interactive Brokers is that you can access archived statements. However, it will cost you $25 for the first statement and $5 for each one after that.

If you obtain a debit Mastercard from Interactive Brokers, you will need to pay 0.50 USD for each withdrawal. A replacement card will cost 3 USD to 10 USD, depending on the shipping you select. Electronic bill pay costs 0.50 USD, and paper bill payments cost 1 USD per transaction.

Interactive Brokers vs. Competition

When looking at Interactive Brokers reviews, it's important to compare it to the competition. One of its biggest competitors is Questrade, which offers lower fees and a better user experience than IB.

Questrade also has lower trading and account fees, but they don't convert to currencies other than CAD and USD. Both platforms are CIPF members, so you can make sure your money is safe.

Another option to consider is Wealthsimple, which doesn't have any account minimums or account fees. The management fees are much lower than Interactive Brokers, and you can rebalance your accounts for free.

Wealthsimple offers excellent customer service, and you can work with a human advisor. It's a much better option for beginner investors, while IB is better for day traders.

You may also want to compare Interactive Brokers to Canadian Big banks. The banks that offer investing platforms can be convenient if you have or want to open an account there.

Consider some of the bigger banks, including CIBC, BMO and Scotiabank. Then, you can determine if they're better for you than IB or the other way around.

Is IB Right for You?

IB is right for investors with some experience who want access to different markets and investments. It's especially useful for those with more money to invest because of the fee tiers.

However, it's not the best for those new to investing because the platform is complex. Get some experience first before using it.