Imagine looking forward to your first pay cheque after starting a new job, only to find out there'll be a delay in receiving your salary because you provided your employer with incorrect banking information.

Despite the efficiency, security, and convenience of online banking, it can quickly become a headache if you don't provide all the banking information required, or worse, you provide all the information but it is incorrect. It leads to transaction delays, and in some worst-case scenarios, it may result in the deposit of the transferred funds into the incorrect account.

However, as a Scotiabank customer, you can avoid this by ensuring you know all of your banking information, including your Scotiabank institution number.

Read on to learn more about your Scotia institution number and where you can find it, along with other important banking information, including your Scotiabank transit number, routing, bank, and account numbers.

Disclaimer:

The content in this article or page is for informational purposes only. While we only conduct the most thorough research and evaluations, and update our content continuously, we cannot guarantee 100% accuracy of the details shown. Users may choose to visit the actual company website for more information.

Banking Numbers You Should Know

There are specific numbers that all financial institutions use to process transactions. If you omit any of these numbers, the transaction will not be successful. Every Scotiabank transaction requires the following numbers:

- Scotiabank Institution Number

- Scotiabank Transit Number

- Scotiabank Routing Number

- Scotiabank Account Number

All of these numbers facilitate the accuracy of your financial transactions and are easy to identify and find.

Scotiabank Institution Number

A bank's Institution Number, otherwise known as the bank code, provides a way to identify each banking institution in the Canadian system, including Scotiabank.

Institution numbers are important as they simplify the processing of transactions between banks. It facilitates the efficient management of deposits and withdrawals. Providing the relevant information results in the accurate and timely completion of the transaction.

The length of each bank institution number will vary based on the standards used in each country. However, it's usually not longer than three digits. Canadian bank institution numbers consist of three digits. It's an integral part of the routing transit number (RTN).

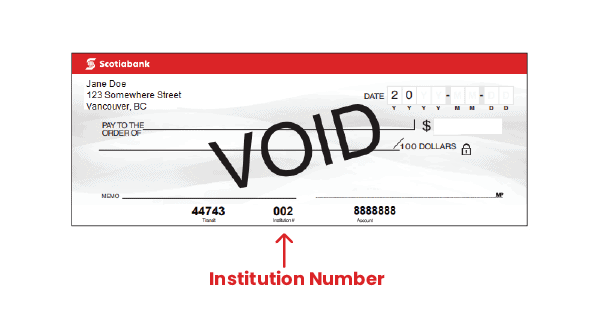

Its placement in the RTN may vary. In the US, it's usually at the beginning of the RTN. In Canada, the institution number appears after the cheque number and the branch number. Look for Scotiabank's institution number, which is 002, at the end of the RTN.

Transit and Branch Numbers

Institution numbers work with your transit and account numbers. Together they help to identify your account to ensure that any funds transferred to you get to your account and payment withdrawals are from the right account.

The bank transit number, which is also sometimes referred to as the branch number, has been around for over 100 years. It is usually five digits long and identifies your branch location. Each of the bank's locations will have a different branch number.

The Bank of Nova Scotia transit number appears on all of your bank's negotiable instruments, which are documents that guarantee the payment of specific sums of money, including cheques. It helps to facilitate transactions between customers across different banks.

Bank Routing Number

Scotiabank's routing number is a banking code that's eight digits long. It identifies the banking institution as well as the specific branch where an account is located. The routing number is a combination of your transit/branch number and your institution/bank number.

However, although the transit and institution numbers are five and three digits long, respectively, there are nine digits in the routing number, as the first digit, which is usually a 0, is the leading number.

Routing numbers generally appear in this format - //CC0AAABBBBB which represents the following:

- //CC0 - Canadian Clearing Code

- AAA - Bank of Nova Scotia or Scotiabank Institution Number which is 002

- BBBBB - Branch Transit Number

However, there are usually two routing number formats:

- Electronic Transfer Routing Number (ETF) - 0AAABBBBB (the first 0 is the leading zero)

- Paper Transfer Transit Number (MICR) - BBBBB-AAA

This, along with your account number, is what you'll need to provide to transfer or receive funds.

Finding All the Numbers Associated with Your Bank Account

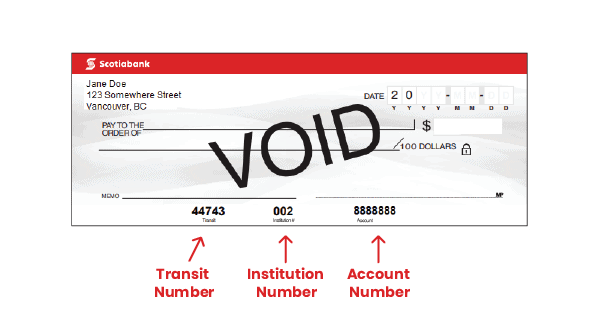

Finding all the numbers listed above is easy. If you have a chequing account, you'll see these numbers every time you write a cheque. You just need to know where to look. These important numbers usually appear at the bottom of every cheque.

Cheques from every institution will differ from one another, but regardless of the bank, each cheque will include the transit, institution, account, and cheque numbers. The order in which they appear may vary, but they will be on every cheque.

When you review your cheque, identify the Scotiabank institution number - 002. It will then be easy to find the transit number, which will appear just before these three digits, as together they make up the routing number.

There's an easy way to ensure you don't confuse it with your individual cheque number, which also appears at the bottom of your cheque. Flipping through your cheque book will help you identify the sequence cheque numbers, as they appear chronologically.

The cheque number will be different on each cheque, whereas your routing and institution number will remain the same. This is the easiest way to identify your routing number.

If You're Out of Cheque Books

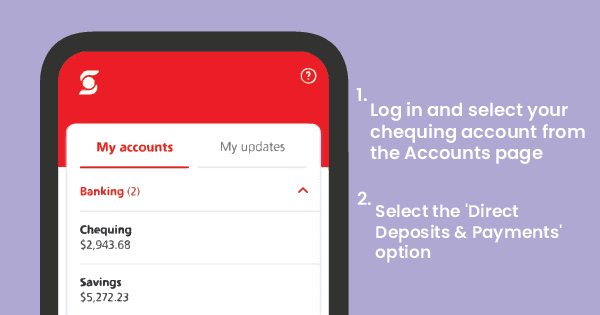

If you're out of cheque books, you can print a void cheque using your Scotiabank online banking account.

- Log in and select your chequing account from the Accounts page

- Select the 'Direct Deposits & Payments' option

- Under 'Void Cheque' click 'View/Print'

You can view the cheque and find the routing number on the bottom of the cheque as described above.

If You Don't Have A Chequing Account

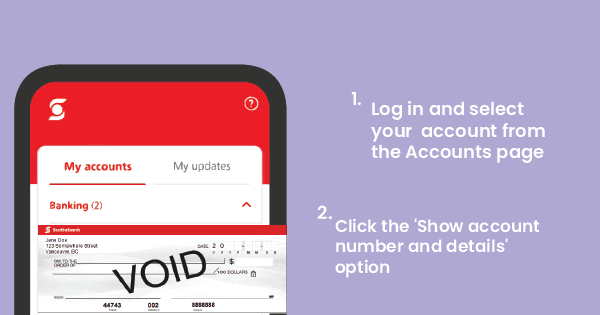

If you don't have a chequing account, you can find your routing number online. Just follow these steps:

- Log in to your Scotiabank account online

- Select your account from the Accounts page

- Click the 'Show account number and details' option

This will allow you to view the institution, branch, and account numbers for your account.

If You Don't Have Cheques or Access to Online Banking

If you don't have any cheques and you don't have access to online banking, you can find your routing number using the address of your branch listed on this site.

If you can't use any of the avenues listed above, contact your local Scotiabank branch, and they'll be happy to assist.

Why Are These Numbers Important?

Your institution, transit, routing and account numbers all help to identify your account at a specific branch at a bank. There are financial services that require the use of these numbers, including electronic fund transactions.

You can learn more on the topic by browsing some of our finance articles.

Outgoing Payments

You will need your routing number, as well as your account number, when you're setting up any pre-authorized payment agreement. This is usually done for insurance, recurring payments such as utilities, maintenance, and rental fees, and other automatic transactions.

A pre-authorized payment agreement is an authorized link between your account and that of the institution or company you've agreed to do the transaction with. It allows your bank to automatically withdraw a specified amount from your account at an agreed time, usually monthly. It eliminates the need to remember due dates or worry about missed payments.

Incoming Payments

You will also need these numbers for incoming payments, such as your salary. Your employer will usually require that you complete a form that asks for your routing number and account number. This information allows your employer to deposit your salary directly into your account.

It eliminates your need to go to the bank and stand in line to deposit your cheque every month or bi-weekly, depending on the frequency of your salary payments.

The same holds true if you're an entrepreneur with your own business. Your clients may want to transfer any payments owed to you via an electronic transfer. To ensure you receive your payments on time, you will have to give them the correct bank information.

Your institution, transit, routing, and account numbers are usually required when you're completing banking transactions. These include wire transfers and recurring payments.

Ensuring A Pain-Free Banking Experience

Online banking provides an efficient way to complete financial transactions without leaving home. It's secure, instantaneous, and many financial institutions either charge a very low fee for each transaction or none at all.

You'll need your Scotiabank institution number and other numbers associated with your account. These include your transit, routing, and account numbers.

You can find out more about other financial services provided by Scotiabank. Insurdinary gives you all this information and more, allowing you to compare the services of various banks. Compare bank accounts on our website to learn more.