While it may not yet be tax season for most of you in Canada, time flies and it's important to prepare. There are so many different tax software program options out there it can be hard to decide.

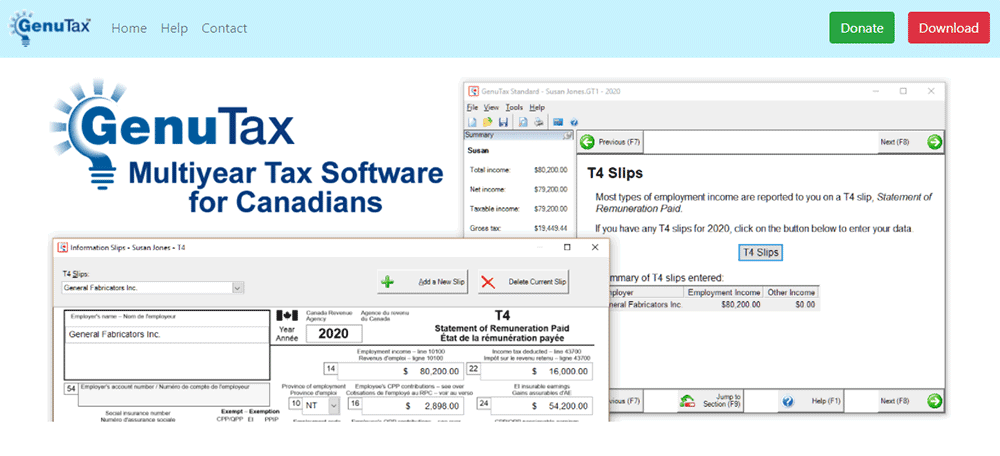

But if you're looking for a robust (and free!) option, then GenuTax is a great software program for you! Before you rush out to try it, it's a good idea to learn everything you can about GenuTax and how it relates to your own situation.

Keep reading to learn everything you could ever want to know about tax filing software in Canada and GenuTax.

Disclaimer:

The content in this article or page is for informational purposes only. While we only conduct the most thorough research and evaluations, and update our content continuously, we cannot guarantee 100% accuracy of the details shown. Users may choose to visit the actual company website for more information.

What Is GenuTax?

GenuTax Canada is a company that is based in Ontario and owned by GenuSource Consulting Inc. They specialize entirely in creating systems like GenuTax. Made in Canada, they know the features and services the average customer will require.

GenuTax provides free updates every year to help you file your taxes.

Is GenuTax Free?

In short: Yes, GenuTax is a free tax software application. In fact, it is one of the only completely free tax software options in Canada. Run almost entirely on donations, this software doesn't have areas that you need to unlock with payments.

Before you even start to look into different tax filing programs, though, you should make sure you are prepared to file your taxes in the first place. It's important that you know what situations you will need to file for and that GenuTax supports them. You can follow our ultimate tax resource for Canadians to learn more.

Is GenuTax Safe?

The world of scams is wide on the internet these days, and it's important to know that you're protected. While GenuTax is definitely a safe program, let's take a look at the how's and why's of the company and why you can trust them.

What Certification Does GenuTax Have?

Did you know that tax software can be certified? This helps you to know that the software is safe and supported by various governing bodies.

GenuTax is recognized by the Canada Revenue Agency or the CRA. This government agency certifies commercial tax preparation software. This certification means the software developed (in this case, GenuTax) has gone through a careful process to ensure the software and services are compatible with the government tax systems.

GenuTax is also certified by NETFILE. NETFILE is another way the Canadian government can recognize tax filing services. NETFILE is an electronic tax-filing service that offers the ability to e-file or send your tax information directly to the CRA.

Generally, you can rest assured that filing your taxes with a product approved by NETFILE will be secure. Ensuring personal and financial information is sent in an encrypted format helps to ensure hackers can view or alter your tax data.

How to Use GenuTax

Now that you know GenuTax is a secure product, it's a good idea to learn if the available features will suit your tax filing needs. To use GenuTax you simply download their product from their webpage and follow the instructions from there. First, let's go over some of the biggest features that GenuTax offers in their product.

Multiyear Support

With this ability, users can file their tax returns for the current year, as well as for the years prior. Currently, GenuTax supports filing taxes for any year from 2003 to 2019!

If you missed a tax year you no longer have to worry and can file those retroactively. It is important to note that if you wish to e-file, GenuTax currently only supports internet filing services from years from 2017 to 2020. If you wish to file earlier years you will simply need to print and mail the resulting paper tax return, all approved by the Canada Revenue Agency.

No Income Restrictions and up to 20 Tax Returns

Unlike many other tax filing programs, GenuTax doesn't restrict filing if you make a small or very large amount of money. This also means that it's great for handling most tax situations in general and is very versatile.

Whether it's capital gains, rental properties, or even small business/self-employed tax deductions that you may be eligible for!

Additionally, you can prepare up to 20 different individual tax returns for each tax year. None of these have income restrictions.

Step-by-Step Interview Guide

The reason why most people these days go for guided tax software is that it takes all the uncertainty out of the situation. No longer do you need to stress about whether you are filing the right forms or using the wrong tax information.

GenuTax takes you through the filing process step-by-step, making this program ideal for beginners. It is important to point out that GenuTax's entire platform is a lot less "fancy" looking than some other filing programs out there. However, it's important to remember that it is free and it works just fine - everything else is just aesthetics.

Auto-Fill Your Return

An extension of the step-by-step interview process - it can be even easier. Using information that the CRA already has on file, GenuTax offers access to their Auto-Fill My Return service. You won't have to fill in every little detail about yourself and will be able to move even more quickly through the process.

It's important to note that you will need accounts with CRA and that it only works for some tax slips. However, they are the most common such as T3, T4, T4A, T4RSP, T2202, and others.

Express NOA and ReFILE

GenuTax supports two popular options. Express NOA helps you to view your Notice of Assessment. This is a way for people to see their complete account summary and results of their return quickly and easily. This will include information about any refunds or balance owing and other important details and statements.

ReFILE is for situations where you realize you need to make a change after you have already filed. Using this tool you can send your updated tax return to the CRA quickly with e-file.

The Reviews

Where to Download

PC Based

Cost

Rating

Reviews

Developer

Downloaded Count

Name

iOS | Android

Yes - URL

Free

NA

NA

GenuSource Consulting Inc

NA

GenuTax Standard

GenuTax frequently finds itself recommended as one of the best free tax filing software options for Canadians. But let us look at some of the biggest pros and cons that people talk about when using GenuTax

Cons

It's important to note that GenuTax does not work on Mac. It only works on Windows 7 and up. For those of you who live or work in Quebec, this program does not have the ability to file Quebec Provincial tax returns.

There are also certain (more niche) situations where GenuTax has restrictions. If you are a farmer participating in Agri-Stability or Agri-Invest or reporting a Nova Scotia Research and Development Tax Credit Recapture, GenuTax does not support this. Additionally, circumstances involving bankruptcy (whether pre or post), or if you're required to complete form T2203, GenuTax does not have the capabilities to file.

In addition to this, users report that support is fairly limited if there are questions or concerns. There is no support available via phone and users are limited to email support. In this case, users can expect to receive replies in under two business days, which can sometimes not be quick enough for certain users.

Pros

Of course, one of the biggest pros of using GenuTax is that it is free. Users are encouraged to donate to cover some of the costs that went into developing the software and the ongoing costs of maintaining it. This is one of the only completely free tax filing software, with no upper tiers or expansion purchase options.

The variety of features that we previously discussed should suffice for the vast majority of users. Individuals rate the step-by-step interview as simple and easy to understand.

It's also a fast system to use, allowing the ability to auto-fill, use Express NOA, and more to get this frustrating time of the year over with as quickly as possible. And of course, it's safe to use as it is certified by the CRA and NETFILE.

While the cons of GenuTax can completely eliminate the software from your list of options, for everyone else this system is one of the best choices you can make.

What Else Should You Know?

Now that you know everything you need to know about the GenuTax online free e-filing system, it's a good idea to consider other areas of your financial life where you could be saving money. Think about your banking, insurance, mortgages, loans, and more. Have you shopped around to find the best rates?

That's where Insurdinary comes in. Here, you can compare rates and save money in as little as 3 minutes! Check us out today for a quote.