Are you aware that under half of all Canadians who have dependents do not have life insurance? Without life insurance, there's no guarantee that your family is going to be able to pay for your funeral and adjust to life without your income coming in.

Thankfully, it's our job here at Insurdinary to find provide people great insurance companies of all kinds. Empire Life Insurance Canada is one of the best and most important Canadian life insurance companies out there.

This article will walk you through how you can create an Empire Life Insurance Log In, and teach you a bit about this great life insurance company along the way.

Disclaimer:

All, or some of the products featured on this page are from our affiliated partners who may compensate us for actions and or sales completed as a result of the user navigating the links or images within the content. How we present the information may be influenced by that, but it in no way impacts the quality and accuracy of the research we have conducted at the time we published the article. Users may choose to visit the actual company website for more information.

Step One: Land on the Home Page

You can't register for an Empire Life Insurance account if you don't make it to their first page in the first place. Head over the home page of the site, which will walk you through some of the reasons why life insurance is so important.

On this page, you'll learn that the new technology available to us in the 21st century makes it much easier to get people proper insurance plans.

You'll also see that there's a lot of free blog content on the Empire Life home page. This is here because Empire Life cares. They're not just there to make sure that you get the best life insurance possible, they want to make sure you have a good life.

You'll learn that they have an opioid management program, create retirement plans, and have options for people to learn just how much life insurance they need.

To get started on creating your login, locate the "Log In" button on the top right corner of the page and put our cursor over it. This will create the appearance of a drop-down menu with options for "Consumers", "Employers and Employees", and "Advisors". Click on the text under "consumers".

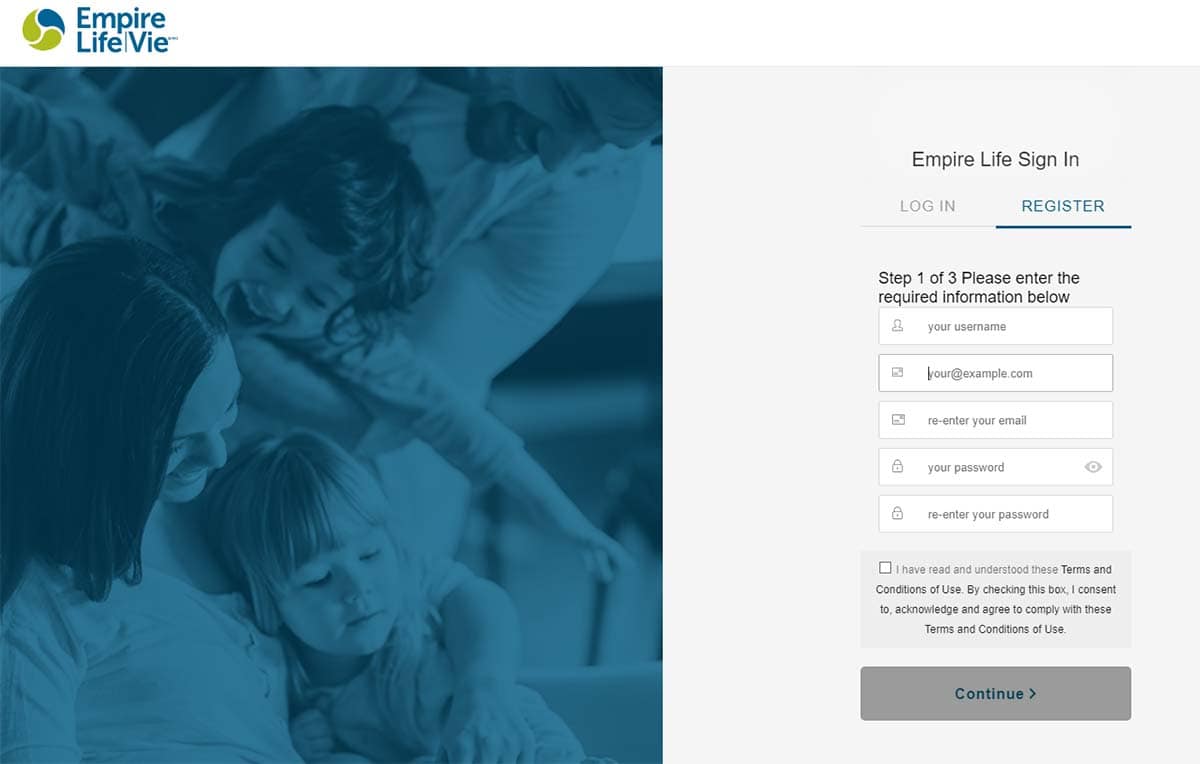

Step Two: Begin to Register

From here, you should land on this page. It will automatically put you on a page labelled "Log in" which will ask you for your username or email and password. You haven't created these yet, however, so you should disregard this.

Instead, click on the text that says "register". There, you'll get options that tell you to enter your username, password, and email.

For your password, make sure you don't use a password that you use on any other platform. If you do this, someone can easily find their way into your insurance account, which you do not want.

For your username, make sure that you pick something that you'll remember. That will be the name you're addressed by on the side.

After this, read the terms and conditions, and click that you've read them. It's important to really read your terms and conditions. You want to make sure you know what you're getting into when it comes to a life insurance policy.

Click on the box that indicates you agree to the terms and conditions.

This will bring you to a page that will attempt to verify that your email address. It will send an email to that address to try to verify your email.

Head to your email account and locate the message from Empire Life. Its headline should be "Empire Life / Empire Vie – Verify your email address / Valider votre adresse de courriel".

This email will contain a link with the hypertext "verify my email account". Click on this link within five days, and you'll be brought to a page that will ask you what you're registering as, "Customer", Advisor or assistant", "Group Plan Administrator", or "Group Advisor or Assistant".

Step Three: Enter Your Information

This step requires you to enter a certain amount of personal information. It will ask you for your first name, last name, date of birth, postal or zip code, and policy or contract number. It will not ask you for anything like your home address or social security number, so you can rest assured that your information won't be taken.

If you're registering as an employer, employer, or registering for a group plan, you're going to need to know the names of companies, businesses, and any people involved.

Enter this information, and they'll create and locate your file within your system.

Step Four: Log In

Once you've gone through all the steps of creating your Empire Life account, it's smooth sailing from here. Head back to the home page. If you want, you can check some more of their content out.

This time, you might take note of the fact that they allow you to manage your investments through their site as well. At first, this might confuse you, but at the end of the day, it's under the same umbrella — trying to help you manage your money.

Here at Insurdinary, we tend to put the emphasis on insurance. However, one of the most important things for your financial wellbeing and the financial wellbeing of your family could just be the investments that you make.

It can give you extra money that you can put away for when your family needs it, and if you teach your children how your investments work, they can still make money from it.

To log in to your account, head over to the top left corner and hover your mouse over the sign that says "log in" once more. This will bring down that same drop-down menu. Click on the text under customer again and head to the "log in" page.

From here, enter the username and password that you created earlier. Click on Log In, and you're in.

Create Your Empire Life Insurance Log In

It's our mission at Insuridnary to provide customers with the most high-quality insurance platforms out there.

Empire Life, in our experience, is one of the best options for Empire Life Insurance out there. If you like what they have to offer, create your Empire Life Insurance Log In today.

However, we can understand if you're looking for something else from your insurance company. Get a quote with us today, and we'll set you up with the insurance company of your dreams.