If you die suddenly, your loved ones may face financial strain. Life insurance eases that burden.

Life insurance is a contract between an insurer and the person who signs the insurance policy. The policyholder pays a monthly premium.

If the policyholder dies, the company pays out an agreed-upon sum. The insurer pays whomever the policyholder named as the beneficiary.

Over 341,000 Canadians have an Empire Life insurance policy. You might discover a policyholder directed payout sums to you upon their death.

In this case, the insurer will not pay you automatically. Instead, you'll need to file Empire Life insurance claims.

Fortunately, there are four ways to submit your claims. You might:

- Submit claims online

- File through a medical provider

- Submit your claim by mail

- File your claim through Empire life's mobile app

All options are legal. Each has pros and cons. Follow this step-by-step guide to file an Empire Life insurance claim--in whichever way suits you.

Disclaimer:

All, or some of the products featured on this page are from our affiliated partners who may compensate us for actions and or sales completed as a result of the user navigating the links or images within the content. How we present the information may be influenced by that, but it in no way impacts the quality and accuracy of the research we have conducted at the time we published the article. Users may choose to visit the actual company website for more information.

1. Submitting Claims Online

Many life insurers let beneficiaries submit claims online. Empire Life is no exception. Submit your life insurance claims online in seven steps.

Find Empire Life Online

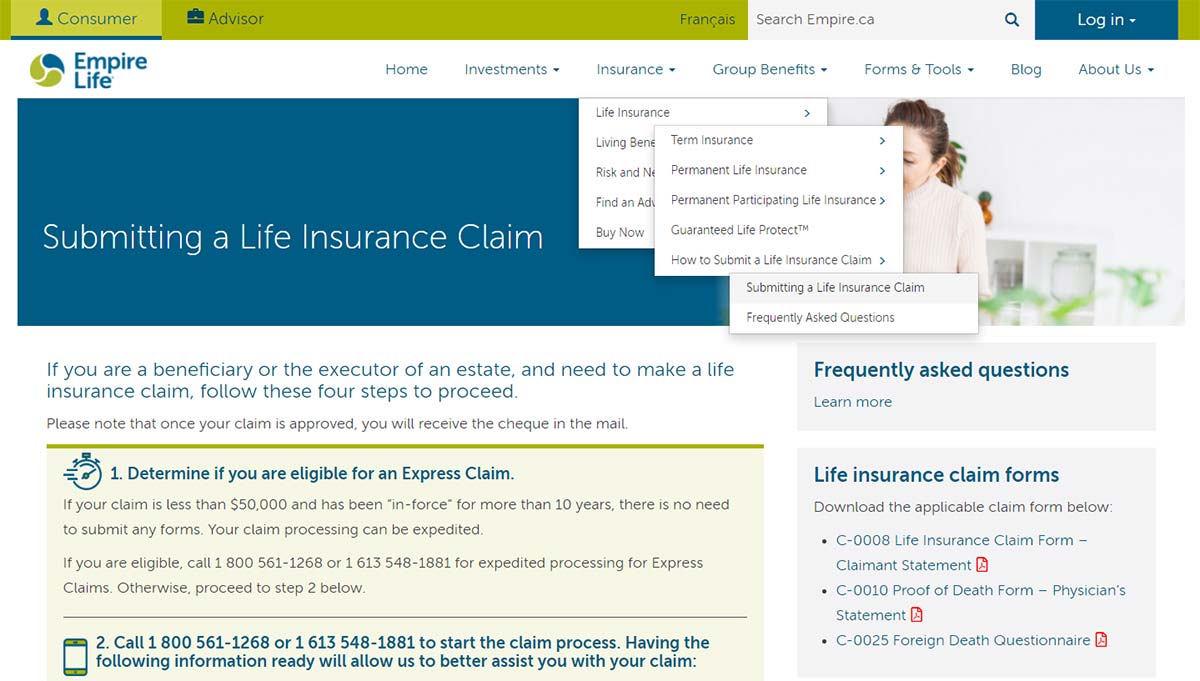

Empire Life's website is EmpireLife.ca. This is the life insurance company's official site.

On the home page, hover over the heading that reads "Insurance." When the drop-down menu opens, choose "Life Insurance."

Then, when the second drop-down menu opens, hover over "How to Submit a Life Insurance Claim." Finally, click "Submitting a Life Insurance Claim."

That will take you to this page. That page includes instructions on how to submit the claim.

Do You Qualify for An Express Claim?

In some circumstances, Empire Life can expedite the claim process. But, it's solely for beneficiaries claiming fewer benefits.

If you qualify, call 1-800-261-1268. If you qualify but currently live outside North America, call 1-613-548-1881.

If you don't qualify for an express claim, gather information.

Call A Representative

You'll have to meet with an Empire Life representative over the phone. To prepare for your meeting, collect:

- The policyholder's account number

- The full name and address of the person who named you as beneficiary

- The policyholder's death certificate

- The name, phone number, and city of the funeral home

- Your own name, email address, street address, and phone number (as beneficiary)

- The executor's name and contact information

With this information ready, contact an Empire Life representative.

Obtain the Right Forms

During your conversation, the representative might tell you to download and fill out claim forms.

Or, the representative might send you the correct form by fax, email, or snail-mail. Empire Life requires at least one of three claim forms. These are:

- Claimant Statement form

- Proof of Death form (this requires a physician's statement)

- Foreign Death Questionnaire

Each form requires you to include different information. This includes your Social Insurance Number (SIN). It also includes the policyholder's SIN and Empire Life policy number.

If you don't know how to answer some of the questions, call Empire Life. Some information is necessary to prevent fraud.

In some instances, a form is best filled out by other parties. In these specific cases, this will not prevent Empire Life from approving your claim.

Ask Questions About Claims Process

A representative can help you work through the claims process at any time between 8:00 AM and 8:00 PM. Agents can help you Monday through Friday.

Once you've filled out the claim forms, submit them.

Submit Claim Forms Online

To file the forms online, send them in via email. The email submission address is: individualclaims@empire.ca

After you submit your claims, Empire Life will review them. It handles routine claims in five days or less.

Empire Life is committed to transparency. If it seems like something's amiss, an agent will contact you with questions. Agents make contact within five days.

Understand Payout Options

Empire Life pays out benefits differently in different circumstances. It might pay via cheque or direct deposit.

Some policies pay out a lump sum. Others offer annuity options. An Empire Life agent can tell you which payment options you're eligible for.

2. Through Your Medical Provider

A medical provider can submit a life insurance claim on your behalf. To do this, ask an eligible medical provider. Eligible providers include:

- Physicians

- Nurse practitioners

- Pharmacists

- Physiotherapists

- Massage therapists

- Chiropractors

- Vision care providers

Empire Life can process a claim submitted by a provider within 24 hours. You will still need specific pieces of your information and the policyholder's information.

To process the claim quickly, your provider must be registered with ProviderConnect™. Or, they must register with an authorized third party. The ProviderConnect™ homepage includes registration options.

Submitting a life insurance claim through your provider grants additional benefits. Empire Life can adjudicate your claim in real-time. You can also learn which benefits you're eligible for instantly.

If you have questions about submitting a claim via your provider, call an Empire Life representative. In North America, call 1-800-261-1268. Outside the continent, call 1-613-548-1881.

3. Submitting Empire Life Claims via Mail

Empire Life empowers beneficiaries to file life insurance claims through the post office. To do this, follow the first five steps under the header "Submitting Empire Life Insurance Claims Online."

Make sure you have all your forms correctly filled out in print. Then, submit the complete forms through the mail.

Empire Life Mailing Address and Fax

Send the forms in a secure envelope. Mail your forms to the following address:

Customer Service, Individual Insurance

Empire Life

259 King Street East

Kingston, Ontario

K7L 3A8 Canada

Another way to submit claims to Empire Life by mail is to initiate communication by fax. Empire Life's fax number is: 1 800 419-4051

You may ask to confer with a representative by fax rather than by phone. Or, in some circumstances, you might meet with an Empire Life representative in person.

Empire Life Street Address

Empire Life may hold in-person meetings at its office. This is located at 259 King Street East, Kingston, Ontario.

It may be wise to request more information about Empire Life representatives' current availability. In some circumstances, they may only meet claimants over the phone.

Empire Life's information line is 1 877 548-1881.

Regardless of how you meet, make sure you end up with the correct forms. If you mail in the wrong forms, Empire Life will deny your claim.

4. Via the Empire Life Mobile App

Unfortunately, you cannot submit life insurance claims via the Empire Life mobile app.

Empire Life's app lets policyholders submit many types of claims. A person with an Empire Life insurance plan has many options.

They can submit any type of claim eligible for eClaim on Empire Life's website. These claims include:

- Vision claims

- Dental claims

- Drug claims

- Paramedical claims

- Incidental health expenses

- HSCA claims

Policyholders also manage account information from Empire Life's app. They can use a mobile version of their benefit card. They can also use their phone's camera to scan and upload receipts.

Unfortunately, a person who benefits from a life insurance policy isn't the policyholder. When a life insurance policy pays out, the policyholder is deceased.

Life insurance claimants seeking benefits from Empire Life are not necessarily Empire Life customers. And, when a life insurance beneficiary is also an Empire Life policyholder, it's merely a coincidence.

So, Empire Life's mobile app includes claims submissions features. But, these features will not help life insurance beneficiaries.

Furthermore, you are unlikely to even have access to the Empire Life mobile app. Chances are, you're a beneficiary, but not a policyholder.

Submitting A Claim When I Have Another Plan

Your current insurance plan--life or otherwise--has no bearing on how to claim life insurance payouts. You are entitled to monetary payouts from Empire Life in the following case:

- An Empire Life life insurance policyholder names you as his beneficiary

- That policyholder passes away

- That policyholder was in good standing with Empire Life when he passed

- You've filled out and submitted your claim forms correctly

Your own insurance status does not impact your entitlement. Nor does your citizenship status.

Claim forms require you to fill out personal information. This might include your Social Insurance Number (SIN). Often, you will also need the deceased person's Empire Life policy number.

But, no form requests your Empire Life policy number. It is completely okay to not have Empire Life insurance yourself.

Which Life Insurance Works for You?

Filing Empire Life insurance claims may be stressful--even when you're the beneficiary. When you die, you'll want your loved ones' claim process to go smoothly.

That's why choosing the right life insurance matters. Fortunately, Insurdinary can help.

Insurdinary lets you compare rates--and policy features--from insurers all across Canada. If you know where you are and what you want, talk to us!

We can get you life insurance quotes in twenty-four hours. Choose wisely, and you've got one less thing to worry