If you are looking for auto financing in Canada, it is important to compare between different auto loan lenders so that you can find the best deal.

A bad car loan can saddle you with high-interest rates, unexpected fees, and could even destroy your credit score. This is why it is crucial to choose between trusted lenders in a transparent manner, without any sale pressure tactics. That's where Car Loans Canada comes in.

Car Loans Canada is one of the most trusted and well-established auto loan comparison platforms in the country, serving nine provinces and close to 2 million Canadian motorists. If you are looking for auto financing and do not know where to start, read our in-depth Car Loans Canada review to find out if their auto loan matching service is right for you.

Disclaimer:

All, or some of the products featured on this page are from our affiliated partners who may compensate us for actions and or sales completed as a result of the user navigating the links or images within the content. How we present the information may be influenced by that, but it in no way impacts the quality and accuracy of the research we have conducted at the time we published the article. Users may choose to visit the actual company website for more information.

About Car Loans Canada

First, it is worth breaking down what Car Loans Canada actually offers, and how it differs from your average lender. Car Loans Canada does not actually offer loans directly. Rather, it connects customers with the right auto loan product for them.

When comparing car loans, how much you will pay and the kind of financing you are eligible for depends on a number of data points taken from your financial profile and personal situation. Car Loans Canada refers your data to a selection of lenders to find the very best loan package for you.

Can I Get Pre-Approved for a Loan?

There are no minimum credit requirements, although you will receive better auto loan offers if you have a high credit score. Based on the information you provide, you can get pre-approval for a loan within 24 hours. After this, it is up to you to apply for the loan via the Car Loans Canada online platform.

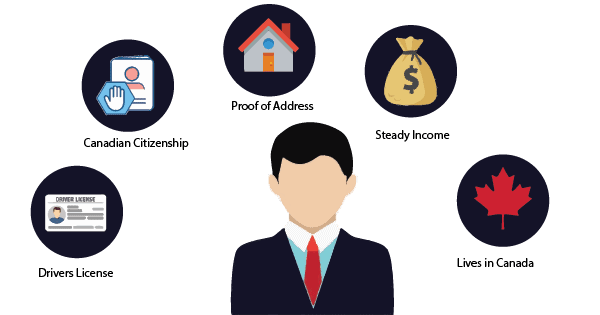

In order to be eligible for pre-approval through Car Loans Canada, you will need to meet a number of requirements.

Eligibility Requirements

Although Car Loans Canada aims to make affordable auto financing accessible to everyone, there are some minimum standards you will need to abide by in order to quality for pre-approval. These are:

- A valid driver's license

- Proof of Canadian citizenship or legal Canadian residency

- Proof of address that matches the address on your license

- A steady source of employment for at least the past three months

- Live in one of the following provinces: Ontario, Manitoba, Alberta, Nova Scotia, New Brunswick, Saskatchewan, British Columbia, Prince Edward Island, or Newfoundland and Labrador

If you fit all of these requirements, you will most likely receive pre-approval for an auto loan offered by Car Loans Canada.

What To Do Before Applying

Before you apply, there are a few things you should do beforehand in order to ensure that the process runs as smoothly as possible. First, you should get a clear understanding of your budget and the kind of auto loan you can afford. To do this, you can use Car Loan Canada's Car Loan Calculator.

In the calculator, you to enter the size of the loan amount you want, the down payment you can make, the province you live in, the length of the loan term, and the car loan rates that you are seeking. The calculator will then give you an estimate of the total cost of the loan and the monthly, weekly, or bi-weekly payments you can expect to pay.

There are a few additional steps you should take before applying, such as:

- Gather your documents, such as your ID, license, pay slips, and proof of address

- Gather your banking information

- Decide on the vehicle you want and determine the price

- Determine the trade-in value of your current vehicle

What Are the Rates?

The rates you can expect to be offered may differ widely depending on your circumstances. The interest rates offered through Car Loans Canada range from as little as 1% all the way up to 29.99%. The average interest rates you can expect to pay will range from around 5.9% to 8%.

If you have a good credit score, expect to pay lower interest rates. Likewise, if your credit score is poor, you will most likely be saddled with higher fees and rates.

However, Car Loans Canada does not have a minimum credit score requirement, meaning that anyone can apply. While lower-score applicants will be offered higher interest, you are still more likely to find a reasonable auto loan through Car Loans Canada, as the service will trawl through all of the top lenders to find the lowest possible rates for you.

Get Pre-Approved for a Loan with Car Loans Canada

A car buying journey you can trust

Get StartedApplication Process Walkthrough

One of the key Car Loans Canada benefits is that the application process is simple and straightforward. If you have all of the correct documentation and information on hand, you can expect to complete the application process for loan pre-approval in just a few minutes. Here is what you need to do:

- Click "Get Started" on the Car Loans Canada homepage

- Enter the type of vehicle you are seeking auto financing for (i.e. car, truck, van, commercial vehicle, or SUV)

- Confirm your age, address, employment status, income, and contact details

- Confirm how much you wish to borrow and the size of the down payment you can afford

After this, a local loan approval center employee will get in touch with you within 48 hours, offering you a loan based on the information you have provided. From here, you can expect to receive the financing you need to get your dream car the following day. Note that the lender may perform a soft credit check on you to confirm your credit score, but it won't affect it.

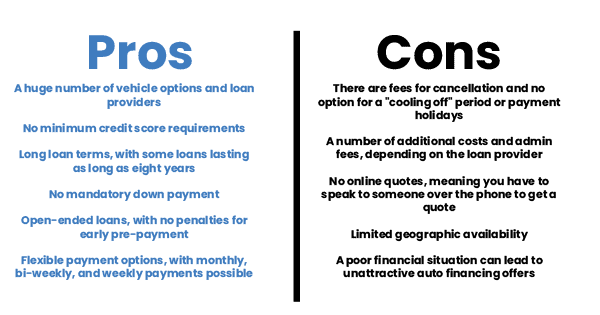

Is Car Loans Canada Worth It?

Overall, Car Loans Canada is a free, easy-to-use, and extensive service that does exactly what it promises. By providing a few basic details, you can find the best and most affordable auto loan for your needs. However, there are pros and cons of the service which are worth keeping in mind, such as:

Pros

- A large number of vehicle options and loan providers

- No minimum credit score requirements

- Long loan terms to suit your needs, with some loans lasting as long as eight years

- No mandatory down payment

- Open-ended loans, with no penalties for early re-payments

- Flexible payment options, with monthly, bi-weekly, and weekly payments possible

Cons

- There are fees for cancellation and no option for a "cooling off" period or payment holidays

- A number of additional costs and admin fees, depending on the loan provider

- No online quotes, meaning you have to speak to someone over the phone to get a quote

- Limited geographic availability

- A poor financial situation can lead to unattractive auto financing offers

Despite these cons, Car Loans Canada remains one of the quickest and most efficient ways to secure your auto loan.

Car Insurance

If you're serious about purchasing a vehicle, you will also need to get insurance. Get a quote from Insurdinary today!