We live in a technological boom right now. With things such as electric vehicles on the roads now, the world just seems foreign.

As the world continues to change, one thing remains the same. Accidents are a reality even with technological advances.

Things are getting better, though. In 2019 Canadians saw deaths by car accidents decrease by 9.1%. But, to be safe, we all need insurance.

Insurance helps protect us when we have accidents. It helps ensure you can afford to operate your business. CAA login and registration will be reviewed here today!

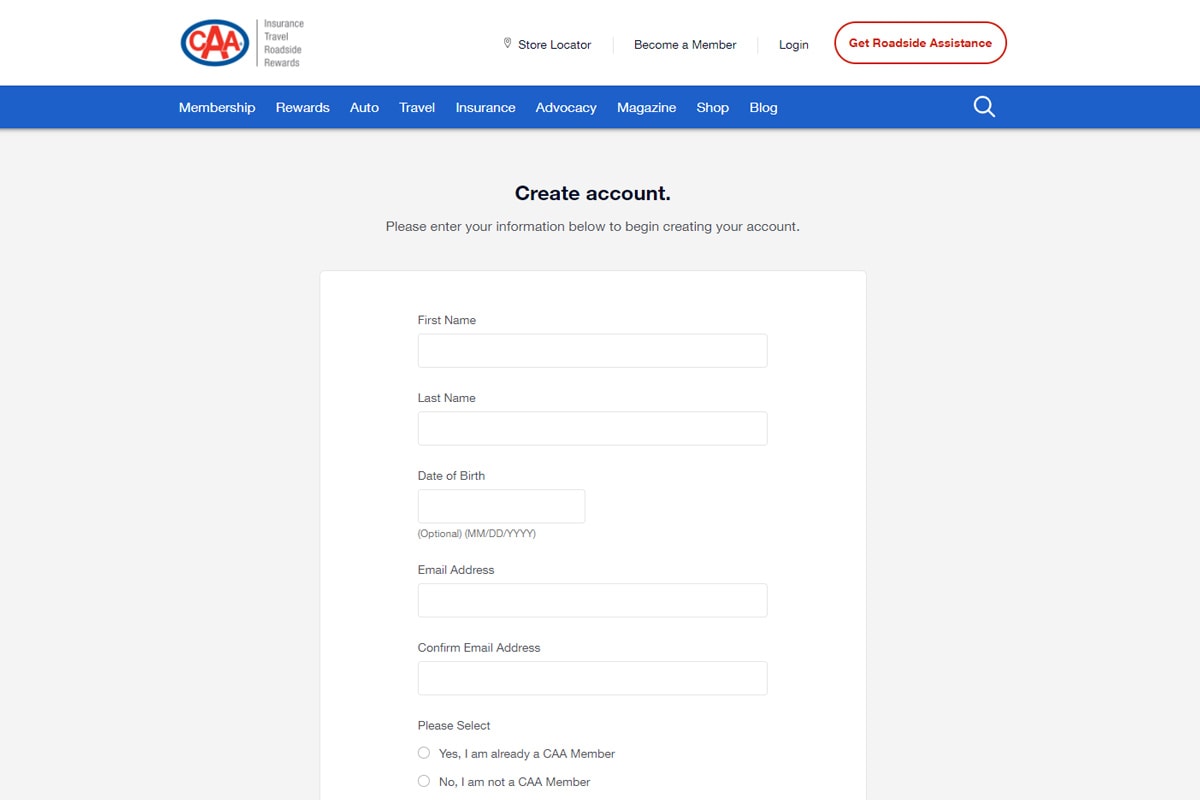

How to Register for Your CAA Insurance Account

In order to register your account, you may need to have a valid policy number. This number is a 16-digit code that you will be provided during your consultation.

When you register your account make sure you record this number. After putting this number in the box you can provide your other personal details in the boxes below.

The personal details you must provide include the following:

- Provide your zip code

- Your email address

- You must confirm your email

- Create your password

- Confirm your password

After you enter your email and your password you must confirm both. Simply repeat your email and password to confirm them.

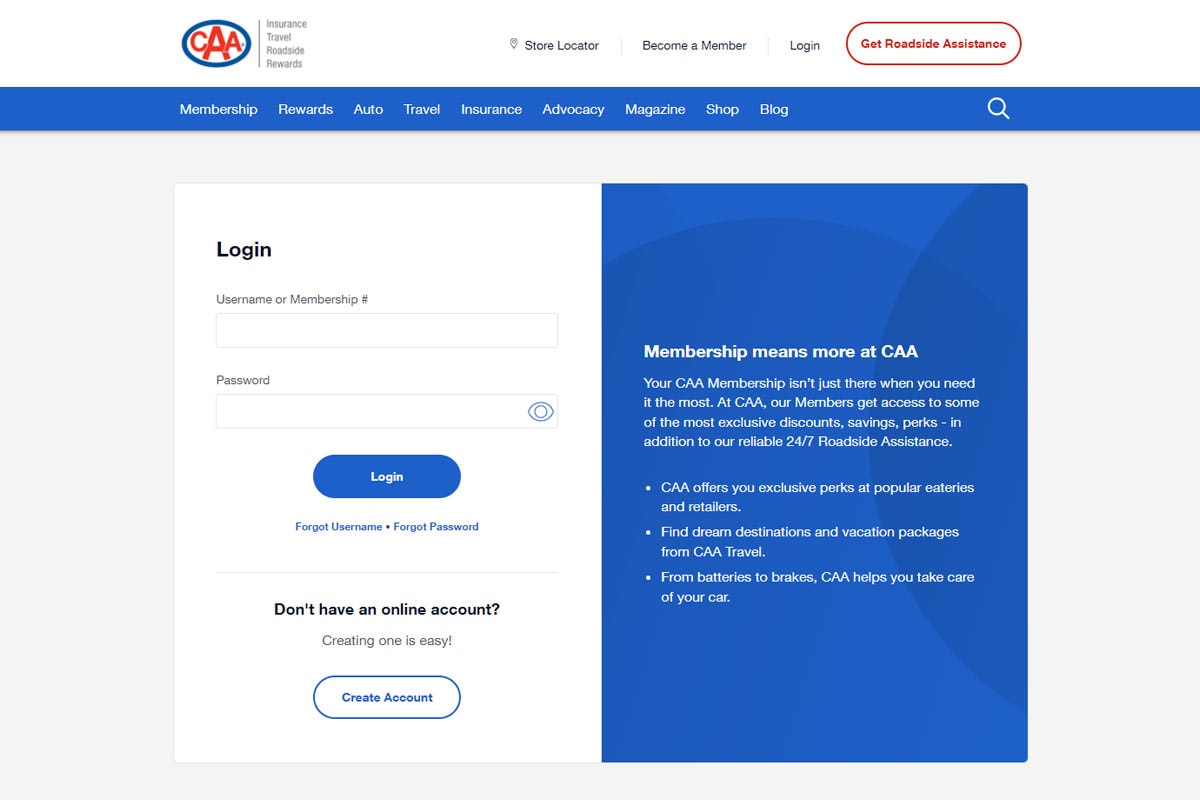

How to Log in to Your CAA Account

After you register your account you can log in at any time. To log in to your account, just provide your username and password.

You should not need to provide your account number again. But, make sure you keep this someplace secure in case you ever need it in the future. It's also useful to have Incase you need to call customer service.

But essentially, if your account is all set, you should not have any difficulty logging into your account. If you do encounter an issue it might be that your count was not set up correctly. If you need assistance you can call them toll-free at 1-800-564-6222.

On their website, they explain they have an unusually high level of calls right now.

Download the CAA App

The CAA app can be downloaded for both Apple and Samsung devices. The app provides easy-to-use and secure access to your account on the road. But, it does more than just this. We will explore this further in the next section.

How do you download the CAA app for your phone? For starters, you need to visit the Apple store or Google play store. If you use a Samsung device you can download this app from the Google play store. You probably already have a Google account set up if you use a Samsung.

However, if you need, you can go to Gmail’s website and follow the instructions to create your account. Once your account is created you can start using Google Play. For Apply devices, the process is a little different.

You usually need an email address, but it doesn’t need to be a specific host. But, once you establish your Apple account with your email you can download it from the Apple store.

Benefits of Having a CAA Account

A CAA account offers you many benefits. The benefits of having a CAA account include ease of access and user-friendly systems. But, if you opt to use their mobile app you can access even more benefits.

These include a rewards program where you earn points through your purchases. You also get rewarded for your good behaviour. For example, if you adhere to traffic laws and avoid getting tickets and citations, your price goes down. And you accumulate CAA dollars.

You can redeem these dollars in savings on your insurance or even purchase a new wardrobe. But, the benefits go beyond the simple aesthetic. Below we delve into the various benefits of this platform.

Submit Claims Online (And Get Reimbursed in 48 Hours)

They provide their users with a simple and straightforward method to submit their insurance claims. By expediting the process, CAA ensures their clients get their claims in ASAP.

Through the online platform and mobile app, users can file claims with ease. And, they can get the filing done in real-time. If you just had an accident, you can take out your phone, open the app, and file your claim.

Their process consists of a few steps. These include the following:

- Call or log on immediately in the event of an accident

- Questionnaire

- Vehicle overview and inspection

- Repair and towing

- Check your claim status

- The resolution

You can either call or make a claim online. Some people find it easier at the moment to call to file their claim. This is a personal preference and the app is very convenient. But, in this case, this is the number you should call 1‑877‑222‑1717.

Check Eligibility and Coverage

CAA provides helpful resources regarding vehicle eligibility on its website. Here they all review the roadside assistance service and what you need to provide.

Roadside assistance is available for eligible members. If you have the mobile app you will have a mobile copy of your membership card. This will come in handy when you are trying to get help on the roadside.

You should also ensure you provide them with details about your vehicle and a contact number to reach you.

Follow up on Claims

CAA provides simple to use resources regarding the status of your claims. You can log on to your account online or through the app and find the details here.

CAA claims on their website that they will keep you abreast of any major developments. They will have contact with the mechanic and will keep you in the loop.

Estimate Reimbursement Amounts

After going over all of the details, CAA will determine your reimbursement and whether you are entitled. Once a reimbursement agreement is made, you can expect to receive it quickly.

CAA claims they strive for fairness and accuracy. Once their review is complete you can expect a payment.

Update Your Personal Information

An essential and useful feature of the app is the ability to change your personal details. You can also perform these tasks on their website.

However, if you never set up a mobile account or you are having difficulties, please call them for help. You can reach them at 1‑800‑268‑3750.

How-To Guides

CAA Canada has a fun and interactive website. On their website, they have many infographic videos to help guide you through the process.

These videos can help you determine the smartest investment for your needs.

Get Insurance Quotes

You can easily request a quote online. If you go to their website you will find their request a quote feature and you just need to follow the directions.

Here they will ask you to put your personal details into their system. This includes details regarding where you live and what your birthdate is.

Beneath these questionnaires, you will see checkboxes. If you requested a quote previously and were denied, you should select this first box. Do not worry, if you were declined before it does not mean they will deny you again. This is especially true if things have changed since last time.

Additionally, you need to notify them if you or anyone in your household has issues with their license. This includes a suspended or otherwise hindered license.

How to Retrieve Your Password

Retrieving your password is simple if you know where to go. On their website, you can follow their prompt to log in. But, you will select the option for a forgotten password. The system will prompt you for some information.

The first information they will request is your policy number or username and your email. If you are uncertain of these things, make sure you give them a call. They will certainly be able to help you make this issue right again.

Contact CAA

CAA Canada is a reliable and dependable source of auto insurance. They do provide other types of insurance as well, but their auto insurance is where they shine. If you find yourself in the need of a new car, make sure you get in touch with them for a quote!

Don’t allow the complexities of the insurance world to overwhelm you. It is always better to prepare than to get caught unawares. We hope this article helped you with your CAA login and registration!

At Insurdinary, we provide the best service for all of your other insurance needs. Call or email us today for a free quote!