Did you know that, according to the Canadian government, 63% of Canadian families in 2016 owned their homes? This was up from the 60% of Canadian families in 1999 who owned their homes then.

If you are planning to become a homeowner as well, then you might be considering using Breezeful.

You already have so much to think about when buying a new home, such as searching for low mortgage rates, considering additional fees, and finding the right property for you. Breezeful can be your one-stop mortgage solution to take some stress off you. However, you might be unsure just how well it compares to traditional mortgage brokers.

Let's jump into this review to find out if Breezeful is the right option for you.

Disclaimer:

All, or some of the products featured on this page are from our affiliated partners who may compensate us for actions and or sales completed as a result of the user navigating the links or images within the content. How we present the information may be influenced by that, but it in no way impacts the quality and accuracy of the research we have conducted at the time we published the article. Users may choose to visit the actual company website for more information.

Online Mortgage With Breezeful

When you’re buying a new home, you need to consider where you stand financially. You need to think about things like your Debt-to-Income ratio (DTI), how much you have saved (or have to save) for your new home’s down payment, and what your credit score is.

This is because a lender will be looking at all of these elements when they’re considering whether or not to provide you with a mortgage loan to buy your new home.

If you have a high income and a great credit score, you might think that you’re getting the best rate no matter which lender you use. If you have a low income or bad credit score or both, then you might think you’ll get a bad rate from any lender.

But it isn't always the case. Of course, some people will go to different lenders and compare the different rates they get. However, this isn’t very time-effective. You’re already spending so much time preparing for your move.

Breezeful is the perfect solution in this case, as their online platform allows you to compare offers from multiple lenders with only a single credit check. Through Breezeful, you are sure to get the best offer for your mortgage loan without compromising your credit score.

What Is Breezeful?

Breezeful is an online mortgage platform that makes it easier for you to find a good mortgage deal for your loan requirement and according to your credit score. This company has both the industry expertise and technological backing to make it possible for you to find a great deal for your mortgage.

Once you provide your information online, the Breezeful platform will search for different potential mortgages with different lenders for you. Their website is very user friendly and it only takes 5 minutes to submit your information. Additionally, you'll be matched with an online Breezeful mortgage expert who will guide you through each step of the process and even negotiate on your behalf.

We will elaborate further on this process in the following sections of our review.

Do You Pay More with Breezeful? How Does Breezeful Make Money?

Considering that this service is so useful, you might be wondering if you have to pay a fee when using Breezeful. Fortunately, you do not. Instead of charging people looking for best mortgage rates, the company makes money from the lenders.

Whenever you choose a mortgage and sign up for it, Breezeful will make money through a finder’s fee.

How Does Breezeful Compare to a Traditional Mortgage Broker?

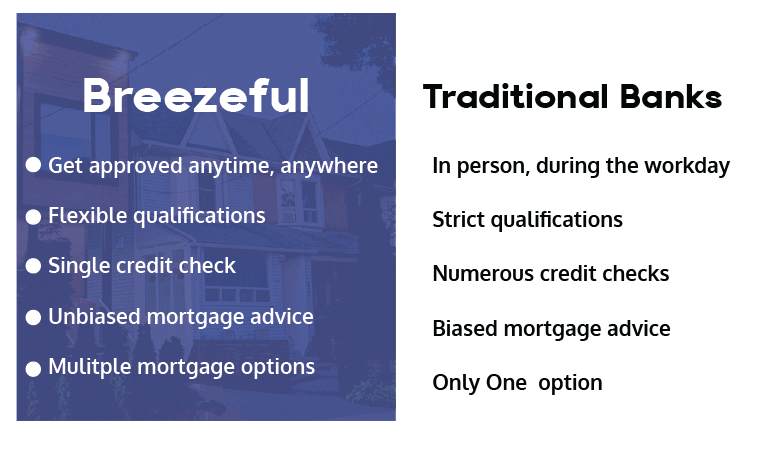

Breezeful offers a digital solution that is simple and secure. You can get approved any time and anywhere, and you can access it in all parts of Canada. Additionally, you’ll have many mortgage solutions available to you as well as flexible qualifications. (We’ll cover these mortgage solutions in just a moment.)

Breezeful works with over 30 Canadian mortgage lenders, including well-known ones such as TD Bank, EQ Bank, Manulife, and Scotiabank. You can also receive advice from professional mortgage brokers employed by Breezeful if you have any questions at any point during your application.

Using Breezeful is a streamlined process, designed to save their customers time and money. However, Breezeful operates entirely online. If you aren’t comfortable using a computer or doing financial activities online, you might prefer to sticking to a traditional broker.

Communication Differences

If you don’t mind communicating through emails and text messages, then you should feel comfortable using Breezeful. Their customer service is known for being timely and knowledgeable, so you can expect your communication with them to be on point.

However, you cannot have face-to-face meetings to discuss your mortgage options or any issues you may encounter, unlike with a traditional mortgage broker.

The Credit Check Difference

Another difference between Breezeful and traditional mortgage brokers is that, with Breezeful, you only get one credit check. They run a credit check before providing you with mortgage options, so your credit score won't be impacted for each result you get.

If you were to act as your own personal broker, by visiting different lenders, you would have numerous credit checks done. When this happens, it can trigger several hard inquiries, which can have a negative impact on your credit score.

Breezeful - Online Mortgage Broker

Save thousands of dollars with rates others won't show you.

Apply nowBreezeful’s Services

Mortgage Products Available

With Breezeful, you can get pre-approval from some of the best mortgage lenders available.

For current homeowners, you can also get a mortgage re-finance. Their knowledgeable customer representatives will also help you figure out whether it's worth refinancing or not. Alternatively, Breezeful also provides mortgage renewals and home equity line of credit.

If you aren’t able to get a traditional mortgage, you can opt for a rent-to-own through Breezeful. With any mortgage product, you can always consult your assigned mortgage specialist for specific information.

Benefits and Features - Summary

As previously mentioned, the website is very user-friendly. Everything you need to know is available on the website’s main page, and more specific information about certain mortgage products and services can be found in the navigation menu at the top.

With Breezeful, you also get access to a mortgage expert. They’ll work directly with you, helping you every step of the way, including both securing the mortgage and negotiating on your behalf. If you have any questions, all you have to do is text or email them, and they’ll get back to you in a timely fashion.

Breezeful has access to over 30 lenders, making it very likely that you’ll get the mortgage deal that you've been looking for.

It's also important to note that Breezeful is designed with every Canadian purchasing a property in mind. This means that, no matter what your financial situation is, they’ll work with you to find a solution.

Can Breezeful Get Better Rates?

“All these features seem great,” you may be thinking, “but can Breezeful get better rates?” The answer is yes. Because all of the different lenders will be competing for your business between each other, this will incentivize them to offer you lower mortgage rates.

How to Apply for a Mortgage with Breezeful

Unlike many traditional mortgage brokers, Breezeful's services are available in all 3 territories and 10 provinces in Canada. Additionally, they want to help people find mortgages who would otherwise have trouble qualifying.

This means that, whether you’ve just moved to Canada, are self-employed, or have a gig-type job, you are likely to be able to get a mortgage through Breezeful.

You will need to have a few documents on hand for a fast application process. These include a list of assets and debts, proof of your income, and a Government-issued ID. You’ll also need to provide access to your credit report.

The Application Process

The first few questions are related to where you are in the home-buying process. Once you’ve put in information about your desired property such as its value and address, you’ll answer questions about your income and credit score.

And then, that’s it. You’ll get some offers that you can peruse through and choose from.

Breezeful - Online Mortgage Broker

Save thousands of dollars with rates others won't show you.

Apply nowHow Safe Is Breezeful?

If you’re worried about using Breezeful because the entire process is done online, don't be. The company was seeded by Y Combinator, the startup accelerator behind Coinbase, DropBox, AirBnB, and Stripe.

Breezeful Review Summary

In this article, we’ve covered everything there is to know about Breezeful. We’ve gone over what Breezeful is and what they offer, how they compare to a traditional mortgage broker, and how to apply for a mortgage with Breezeful. Start your mortgage application today.