Are you searching for a good travel rewards credit card in Canada so you can kill two birds with one stone every time you choose to travel to some beautiful place on your bucket list? BMO World Elite Mastercard is considered one of the best travel rewards credit cards in Canada and for good reason.

It comes with a host of features and benefits with very good rates and fees. It's something you need to look into if you are interested in enhancing your travel experience further. Keep reading to learn more about this 'elite' travel rewards card.

Disclaimer:

The content in this article or page is for informational purposes only. While we only conduct the most thorough research and evaluations, and update our content continuously, we cannot guarantee 100% accuracy of the details shown. Users may choose to visit the actual company website for more information.

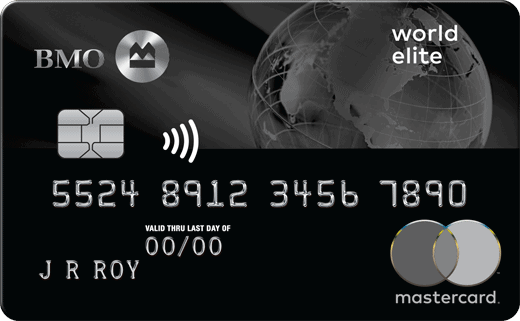

BMO World Elite Mastercard

- Annual Fee: $0 (first year waived, $120 afterwards)

- Eligibility: Canadian resident, age of majority, minimum income and credit score requirement

Special Offer

The first thing to look at in this travel rewards credit card is its welcome offer. And it's a good one.

You receive up to 30,000 points when you apply for and are approved for the BMO World Elite Mastercard. The first 25,000 points come to you when you spend $3000 in the first 3 months plus 5,000 points on your first anniversary. Additionally, the $120 annual fee is waived in the first year!

All this sounds quite enticing, doesn't it? The features and benefits listed below will sweeten the pot even more.

Features and Benefits

This travel rewards credit card from BMO comes with many features and benefits, which will make you realize why so many people have chosen this as one of the best travel reward credit cards in Canada.

Let's look at some of the features and benefits in detail below.

Welcome Bonus

Already mentioned above, the welcome bonus of 30,000 BMO reward points is the best part about signing up for this credit card. Even if you already have a Mastercard, but you travel a lot, you need to have this travel rewards credit card to ensure you are making the most of all your travel experiences.

Travel Insurance

If you travel quite a bit during the year for work or pleasure, getting travel insurance separately for each trip is a hassle and can be exorbitantly expensive. It can deter you from travelling altogether.

But with a BMO World Elite Mastercard, you are covered for unlimited trips throughout the year. That's right, no matter how many trips you take in a year, you are covered up to $2 million in eligible medical expenses for all trips of 21 days and under.

This is a great whoosh of relief for many Canadians who like the idea of adding more travel to their annual roster but worry about unexpected medical bills. The Canadian health insurance plan will not pay your medical bills when you are outside the country or will cover a small part of it, but not upfront.

Some emergency medical expenses (like ambulance rides, surgery, and more) can add up quickly especially if you are in a foreign country where foreigners are sometimes charged 'foreign rates'. It's always a better and safer option to have travel health insurance, such as the one the BMO travel rewards credit card offers.

Earn Rates

Whenever you purchase anything with your BMO World Elite Mastercard, you will receive 3 times the points! This is for every $1 spent on eligible travel, dining, and entertainment purchases.

Great news for all Canadians who like to splurge a bit on themselves when travelling overseas, on meals, train tickets, and event tickets. You don't need to feel guilty about using your credit card for all these purchases, as you are going to earn lots of points in return. So swipe away!

Airport Lounge Access

With this travel rewards MasterCard, you get free membership in Mastercard Airport Experiences provided by LoungeKey, plus 4 free passes a year. If you have never had an airport lounge experience before, but have always envied others who seem to zoom into these spaces, it's time you took off your green glasses and got in on the action.

Click for a list of all open and eligible airport lounges in this program.

Additional Benefits

Let's review some of the benefits of BMO rewards points in general.

- No blackout periods - you can redeem BMO reward points for cruises, flights, hotels, rentals, and vacation packages

- No extra costs - your points will cover everything from fees to taxes

- You can even use your points to contribute to your savings or investment account at BMO

- Pay with points - use your points to pay for whatever purchases you want

- Add another cardholder for only $50 a year

- Get an extended warranty and purchase protection on eligible purchases

- Get 25% off rentals at participating National Car Rental and Alamo Rent a Car locations

- Get 15% off admission to Cirque du Soleil shows touring Canada and 20% off resident shows in Las Vegas

- Don't ever be without Wi-FI - connect to over 1 million Wi-FI hotspots with Boingo Wi-Fi

With such a lineup of fantastic benefits, it's no wonder that this travel rewards credit card is called 'World Elite'.

Rates and Fees

As mentioned earlier, the annual fee of $120 is waived in the first year. The interest rates on purchases and cash advances are as follows:

- 20.99% for purchases

- 23.99% for cash advances (21.99% for Quebec residents)

Not only is the annual fee well worth it due to all the benefits and features, but the interest rate is also quite reasonable!

How to Get the BMO World Elite Mastercard

Due to the 'elite' status of this travel rewards credit card, the eligibility requirements are quite high as well. You need a minimum of $80,000 (individual) or $150,000 (household) in annual income. Considering Canadians have one of the highest standards of living in the world, this doesn't seem that hard to manage.

Earning and Redeeming Points

BMO makes it easy for you to earn points in a wide variety of ways. And redeem it, too. Let's look further into it.

How to Earn Points

Every time you eat out (no special occasion required) or go for a weekend tropical getaway to Mexico or Cuba, you can earn 3 times the points on every dollar spent on eligible travel, entertainment, and dining out expenses. You will also earn 2 times the point on every other dollar you spend everywhere else. That's why you need to get swiping!

Also, car rentals are no longer a pain, but a boon to Canadians, since you get 2 bonus points for every dollar you spend on rentals at participating National Car Rental and Alamo Rent a Car locations. No need to schlep your family around in a bus or train anymore, but road trip it everywhere!

How to Redeem Points

It's easy to redeem points - as easy as logging into your bmorewards.com account and clicking the Pay with Points tab.

Then you would browse your recent transactions and select which eligible purchases you want to redeem points for. You can choose how many points you would like to redeem towards your purchase - it can be as little as $1. There are no restrictions here.

How Does It Compare to Other Top Competitors?

Let's see how this BMO World Elite Mastercard compares to other travel rewards cards in Canada. The other two cards we will look at today are the American Express Cobalt Card and TD First Class Travel Visa Infinite Card.

BMO World Elite Mastercard

- receive 30,000 points ($300)

- lower point redemption flexibility

- $120 annual fee, first year waived

American Express Cobalt Card

- receive 30,000 points ($300)

- higher point redemption flexibility

- no minimum income requirement

- does not waive $156 annual fee

- comes with baggage loss and baggage delay insurance

TD First Class Travel Visa Infinite Card

- receive 80,000 points ($400)

- lower point redemption flexibility

- $120 annual fee, first year waived

- comes with baggage loss and baggage delay insurance

These are just a few points to consider when thinking about which travel rewards credit card to get. Everyone's needs and desires when travelling are going to be quite different.

Pros and Cons

As with all credit cards out there (travel or not), there is no one-size-fits-all card. Every card will have its pros and cons and that's why doing your due diligence to figure out which card fits your needs best is essential.

For example, if you care about having access to airport lounges, then the BMO card is perfect for you. But if you are interested in collecting points that are easy to redeem, then the American Express Cobalt seems to be better in that regard.

Look through the benefits and features list above and you will have a better idea of whether this BMO reward card is suitable for you and your family's travel needs.

The Reviews

New travel rewards credit cards are popping up all the time, but the fact that BMO World Elite Mastercard is still on the market and lauded as one of the best travel rewards cards out there says something about its stickiness in the market.

If you are interested in comparing the best credit cards, insurance rates, mortgages, or more in Canada, then check out Insurdinary's website today.