Since the beginning of the COVID-19 pandemic, the Bank of Canada has been working hard to keep interest rates low. By sustaining a low interest rate, the Bank of Canada is supporting all Canadians through one of the worst economic crises of the modern-day.

And, they'll continue to hold a low rate until they meet their inflation objective.

But, what exactly does this mean for Canadians? Why should we care so much about the Bank of Canada interest rate?

Why Is the Bank of Canada Interest Rate Important?

Whenever the Bank of Canada announces its interest rate, people flock from all over to hear. Their interest rate impacts all Canadians whether you're a saver or a spender. From the Bank of Canada's interest rate, we can learn deduce our savings account interest rate or how much interest we'll have to pay on a loan.

By setting short-term interest rates, the Bank of Canada has the unique ability to manage the overall economic health of the country.

Every year, the Bank of Canada sets eight dates on which it will update its monetary policy. This is the time when the media gathers to learn and spread the news of the new interest rate.

All in all, the Bank of Canada protects Canadians from rapidly increasing prices, while also protecting Canadians from all of the harmful effects of inflation.

What Are Overnight Lending Rates?

In order to influence interest rates, the Bank of Canada has to set an overnight lending rate. This is a target interest rate that the Bank of Canada sets. It also determines the amount that banks pay in order to borrow money from the Bank of Canada for a day.

This all occurs overnight because each commercial bank in Canada has to settle its accounts at the end of the day. If any one of these commercial banks finds out that it is in the red, they must borrow money from the Bank of Canada to settle their accounts.

The Bank of Canada manages the entire process and sets the interest rate that these borrowing banks have to pay on their loan.

By raising or lowering this interest rate, the Bank of Canada also affects the prime rate. This is the rate that the most creditworthy customers get from banks and lenders. Thus, it's the rate that people with high credit scores get.

The prime rate is also the basis for the rate that banks charge other customers for loans.

So, by changing the overnight rate, the Bank of Canada has control over all of the interest rates. This gives the Bank of Canada more control over the economic health of Canada as a whole.

Why Did the Bank of Canada Reduce Its Rate?

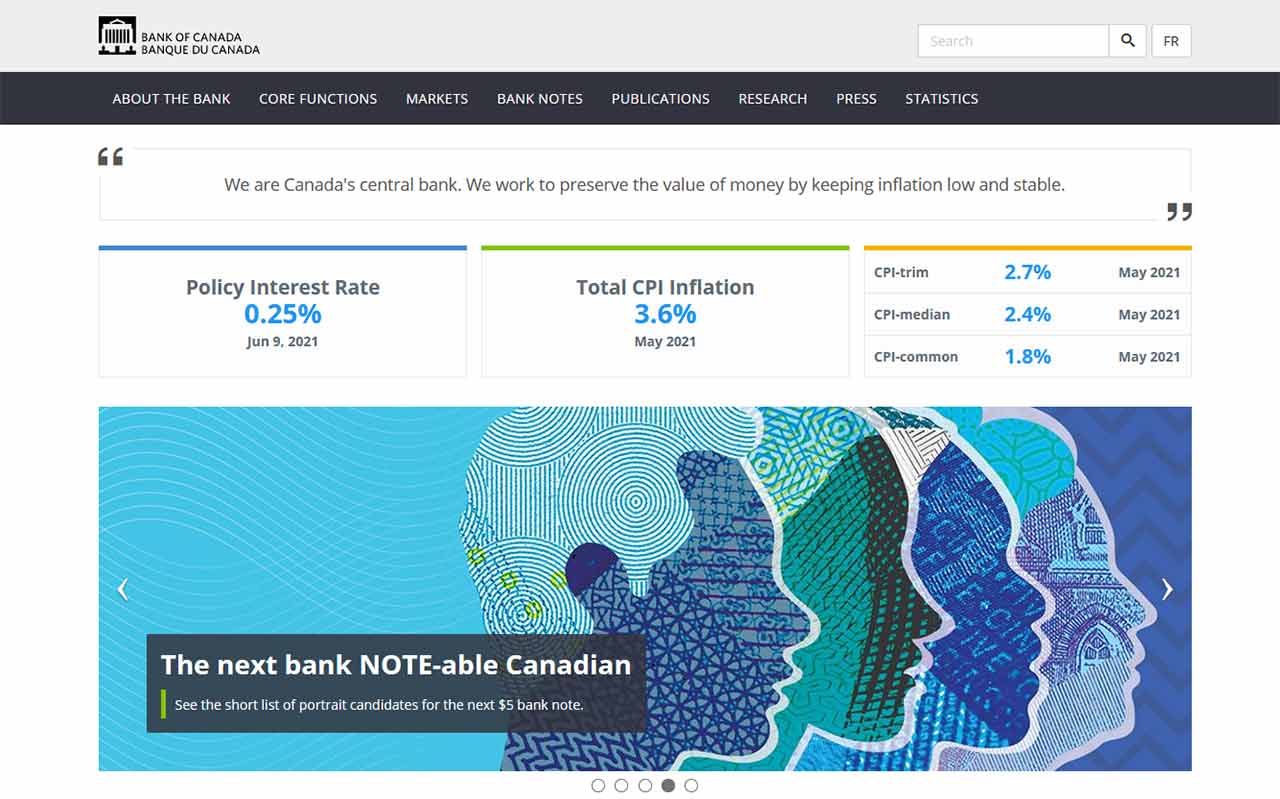

Bank of Canada reduced its rate at the start of the pandemic. Per their monetary policy, the Bank of Canada dropped their interest rate to 0.25% to support the continuation of economic activity.

By doing this, the Bank of Canada is supporting both consumers and businesses as they're lowering payments on current and future loans.

Luckily, the Bank of Canada is going to continue with this 0.25% interest rate until they reach their inflation goals. So, this interest rate will continue to push the economy in a positive direction.

What Do High Interest Rates Do for the Economy?

If the Bank of Canada were to implement high interest rates, the entire economy could collapse. From a housing crisis to a debt crisis, a high interest rate wouldn't fair well for Canada.

Canada is dependent on the housing market for its overall economic health. With high interest rates, the housing market would collapse into nothing overnight, leaving Canada's economy in shambles.

Higher interest rates would prevent most households from being able to afford the homes that they want. And, with fewer people buying, fewer people will be selling.

This would then cause mortgage borrowers to go into debt. In turn, banks and other lenders wouldn't get their payments and the entire economy would go under.

However, that would all pale in comparison to the government funding issues that would happen. In order to save all of these banks, the government would have to increase funding and support. Thus, the government would go into more debt than it is currently in.

In order to save money, the government would have to make spending cuts and raise taxes.

From there, everything would tumble. Car payments would go through the roof. Student loans would never be resolved.

All in all, Canada can't afford to have interest rates that are too high. This is exactly the disaster that the Bank of Canada is trying to prevent by implementing its current rate.

Are Low Interest Rates Sustainable?

Some financial experts are worried about the implications of low interest rates just as much as the implications of high interest rates. As of now, the Bank of Canada is suggesting that interest rates may remain low until 2023. This doesn't necessarily mean that the interest rate will stay at 0.25% until then, but it will remain low in relation to interest rates prior to the pandemic.

While this may sound great to all of the Canadians who are looking to buy a house or a car, it may not be as great for the economy at large.

Financial experts express concern about variable-rate loans. Those who have invested in variable rate loans may not be able to recover from the change that's going to occur once the interest rates level out.

To remind you of the difference between variable and fixed rates, variable rates change over time while fixed rates don't. This means that variable rates are going to change when interest rates eventually increase again.

So, these individuals who have been paying record low interest rates will suddenly be paying higher rates.

As restrictions ease and the economy slowly returns to normal, the inflation rate is set to be a little higher than it was before the pandemic. While experts hope that the Bank of Canada is preparing for this, there's no telling how Canadians will react to the new normal of interest rates.

Should the Bank of Canada Be Worried About Runaway Inflation?

The Bank of Canada is currently looking to protect Canadian citizens from all harmful alternatives. There's no way to predict the future of the economy with certainty, but the Bank of Canada is doing all that it can to prevent things like runaway inflation, or hyperinflation.

Unfortunately, it is a possibility that runaway inflation could happen.

Experts have been urging the Government of Canada to look past the overall health of the economy. While the Canadian economy looks strong as a whole, financial professionals worry about the most hurt sectors of the economy. These are the industries that still haven't begun to recover after the loss that the pandemic caused.

By giving extra attention to these areas, experts believe that we could avoid the harmful effects of pandemic era policies. This means that we'd be avoiding runaway inflation, a housing crisis, and the complete downturn of banking and lending institutions.

Should You Get Lock-in Mortgage Now?

The Bank of Canada is offering a record low interest rate during this time. Because of this, many people think that they should jump into getting a mortgage right now.

But, it's a little more complicated than just getting a lower interest rate. You have to consider what's going on with the Government of Canada and its bond yields.

What Are Bond Yields?

The Government of Canada bond yields and fixed mortgage rates have a direct relationship. When the bond yields increase, the mortgage rates increase. When the bond yields decrease, the mortgage rates decrease.

Since the beginning of the pandemic, the Government of Canada's bond yields have been lower than ever. In fact, the Bank of Canada started its Canada Mortgage Bond Purchase Program.

This is a program in which the Bank of Canada buys mortgage bonds from lenders. This calms lenders and decreases the mortgage rates.

The Bank of Canada stopped aggressively buying these bonds in October of 2020. Many people feared that mortgage rates would skyrocket afterward, but this wasn't the case. In fact, mortgage rates have remained somewhat steady since then.

However, many experts feel that mortgage rates may begin trending upward sometime in 2021. So, it may be time to buy a house and take advantage of low mortgage rates now.

Where Can You Get the Best Mortgage Loan?

With all of this talk about the Bank of Canada interest rates, it's likely that you're curious about the rate you could get right now.

Luckily, our team here at Insurdinary has pulled together a list of multiple mortgage lenders so that you can find the best mortgage rate for you. Take a look today and see if you can get in on these rates before they change.