If you're in the market for a credit card in Canada, you've almost definitely heard of Capital One. Capital One is a titan of the credit card world, bringing in tens of billions of dollars worth of revenue every year.

But what products do you have access to with Capital One? How do they update themselves to our ever-changing world?

This article will walk you through everything you need to know about Capital One, so you can better consider whether or not you want to go with them.

Capital One Credit Cards Reviews

The single most important factor in why Capital One is so highly regarded is because of the diversity of their products. Their credit card offerings feature cards for credit scores ranging from bad to excellent. This is great news for folks who are rebuilding their credit as well as for those who are already established and looking for special features and perks. It's no surprise that many of their products have won numerous Wallet Hub awards over the years.

Guaranteed Mastercard®

One of the most famous benefits of Capital One is their Guaranteed Mastercard system. It allows you to set up credit, or repair a credit history that has been damaged with great ease.

When you gain access to a guaranteed MasterCard, you won't be held accountable for unauthorized use of your MasterCard. That means if your card gets stolen, you can rest assured that Capital One has you covered.

You'll be able to use your credit card whenever you need it, with a guaranteed system to make sure you'll never exceed your limit. This zero liability system is great for anyone looking for a first credit card, which can set them up with a good credit score. A good credit score can set them up for success in the future.

Low Rate Guaranteed Mastercard®

The Low Rate Guaranteed Mastercard is a variation on the same theme. Once again, you have guaranteed approval, and won't be held liable for any fraudulent expenses. It's a wonderful first-card option.

The annual fee is a little bit higher, but interest rates on purchase and balance transfer are significantly lower. Check it out yourself, and weigh the advantages and disadvantages of each type of card.

No matter how you slice it, however, they're both great early credit card options that will help you set interest up for the future.

Guaranteed Secured Mastercard®

The guaranteed secured MasterCard works a little differently. The annual fee is the same amount as the Guaranteed MasterCard, and less than the Low Rate Guaranteed Mastercard. However, this card requires security funds.

At the end of the day, these are two different options for people who are looking for different things. If you'd rather have some extra money in case things go bad, we recommend going with the secured MasterCard.

Aspire Travel™ Platinum Mastercard®

If you're someone who travels often, the Aspire Travel Platinum Mastercard is a must. For no annual fee, you'll earn a dollar of travel awards for every hundred dollars you spend. These reward miles don't have an expiration date, and there's no cap to the number of miles you can earn.

It's very easy to redeem this MasterCard. You can also add one other person to your plan, and maximize the rewards you earn.

Don't forget about the insurance benefits as well. You gain insurance on baggage delay, common carrier accidents, and car rental accidents.

Familiarize yourself with other types of insurance in our insurance section.

Aspire Cash™ Platinum Mastercard®

The Aspire cash program is yet another take on a familiar theme. This one, however, offers you one percent on every dollar that you spend.

At the end of the day, you're going to have to weigh this against the above option. Check out the page and figure out which you'd prefer yourself.

Capital One Mastercard® (Exclusively for Costco Members)

Costo revolutionized the world with its approach to retail. They're a members-only program that provides big boxes of supplies that just aren't available anywhere else. Their member's program allows them to offer uniquely low prices — as long as you're willing to stock up.

If you're a member of Costco, Capital One has your back Their exclusive MasterCard allows you to earn 3% rewards on restaurant purchases, 2% on gas purchases and up to 1% on all other purchases.

If you were worrying about carrying an excess number of cards — don't. Your Capital One card also acts as your Costco card.

Having said that, the Capital One and Costco partnership is coming to an end by early 2022. Find out more about why, and who is stepping in to replace them here.

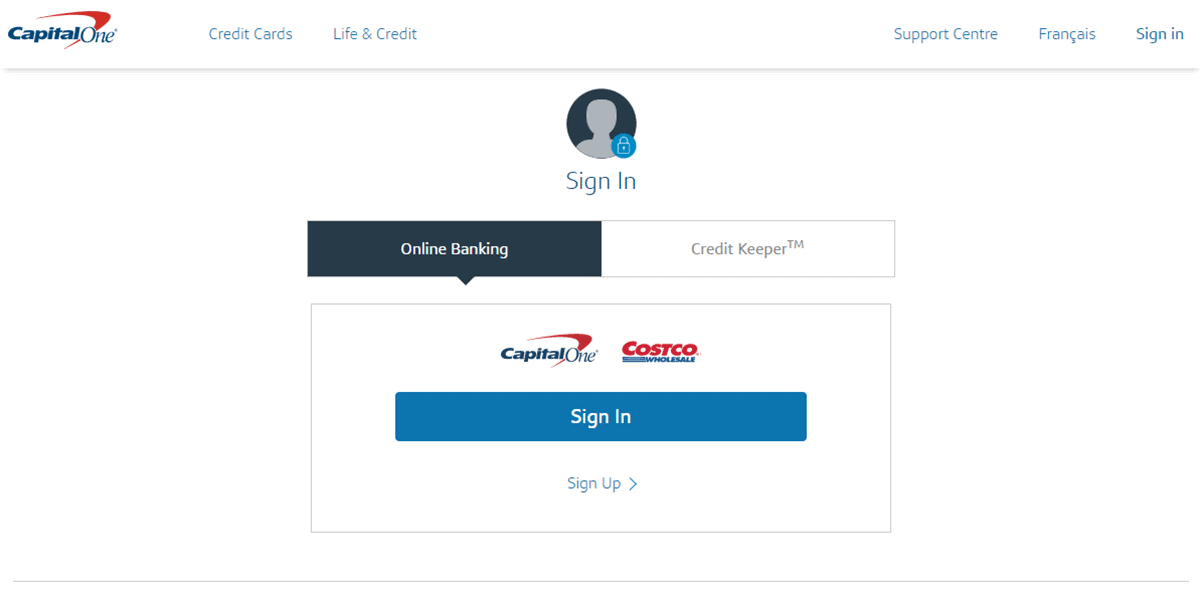

Capital One Login

If you already have Capital One and wish to make use of the many benefits of their online services, you need to create a login.

To get a Capital One login, head to the top right of their page and click on the button that says "sign-in". Under the big blue "sign-in" button, there should be a smaller "sign up" text.

Click on "sign up". From here, you'll be asked to create an account by writing your last name and social insurance information and date of birth. You do this so they can locate you within Capital One's system to bring you online.

After this, you'll be brought through a few more verification steps and create your account. Type the "username" and "password" you've created on the home page, and enjoy your Capital One benefits.

Capital One Support Centre

If you have any problem switch your Capital one service, you can easily head over to the Capital One Support Centre. Simply scroll down to the bottom of the Capital One homepage and click on the text that says "support center".

This will bring you to a hyperlinked FAQ that will attempt to solve your problem. You can also use the Support Centre support bar, so you don't have to waste your time scrolling.

Get the Best Insurance

As you can see, Capital One is a great option for great credit cards. You have access to many exclusive products and can enhance your experience with other companies as well. Any Canadian will do well to put their trust in Capital One.

However, we can understand if all of this talk about credit cards worries you a bit. With credit cards, you need to make sure that you're insured. Our job at Insurdinary is to make you feel as comfortable in the world of insurance as possible.

For more information, keep exploring our site. We're sure you'll find the insurance company of your dreams. For our full service, get a quote with us today.