You've applied for a new job, aced the interview, and the hiring manager requests a background check — no problem, right?

When you finally receive a phone call, you're stunned to learn they've gone with someone else. The reason? They took a look at your credit score, and it was...not great.

Can employers really check a candidate's credit score before offering a position? Absolutely — and around 81% of Canadians didn't know that.

What's more, sixty-one percent had no idea that landlords can check your credit, and two-thirds didn't know that insurance and cell phone companies take a look too. The kicker? Over half of the population has never actually checked their credit scores.

That brings us to the elephant in the room: Canadians could use a little help when it comes to credit monitoring.

Because of this, companies are stepping up to help, including Borrowell. The Toronto-based company provides free credit checks and monitoring, along with personal loans and tools to help improve your credit score.

In the following review, we'll cover everything you need to know about Borrowell's free credit reporting and financial services.

Disclaimer:

All, or some of the products featured on this page are from our affiliated partners who may compensate us for actions and or sales completed as a result of the user navigating the links or images within the content. How we present the information may be influenced by that, but it in no way impacts the quality and accuracy of the research we have conducted at the time we published the article. Users may choose to visit the actual company website for more information.

Borrowell Review: An Introduction

Gone are the days of paying for a credit check. Borrowell is the first company to offer free credit scores in Canada. It also provides an array of financial services that, according to Co-Founder and CEO Andrew Graham, "help people make great decisions about credit."

The company was founded in 2014, and since the launch of its free credit monitoring service in 2016, more than one million Canadians have logged on to view their reports.

Borrowell has also won multiple awards, including ranking 4th on the Deloitte Technology Fast 50 list of fastest-growing companies in Canada, making App Annie's list of Breakout Finance Apps for 2019, and being named one of the top 100 fintech companies in the world by KPMG.

The team at Borrowell, founded by Andrew Graham and Eva Wong, is comprised of technology and financial experts passionate about helping others improve their finances. The company has partnered with some of the most well-known financial institutions, including American Express, Capital One, BMO, National Bank, and Scotiabank.

Moreover, Borrowell has introduced Canada's first AI-powered credit coach (known as "Molly"), who provides personalized tips and advice for understanding and improving your credit.

Borrowell's Free Credit Check and Credit Report

So, how does this free credit check work, exactly?

Generating your credit report is pretty simple. You create a Borrowell account using your email, complete the online form with your personal information, and answer some identity verification questions. Voila — your free Borrowell credit report awaits!

Your Credit Score

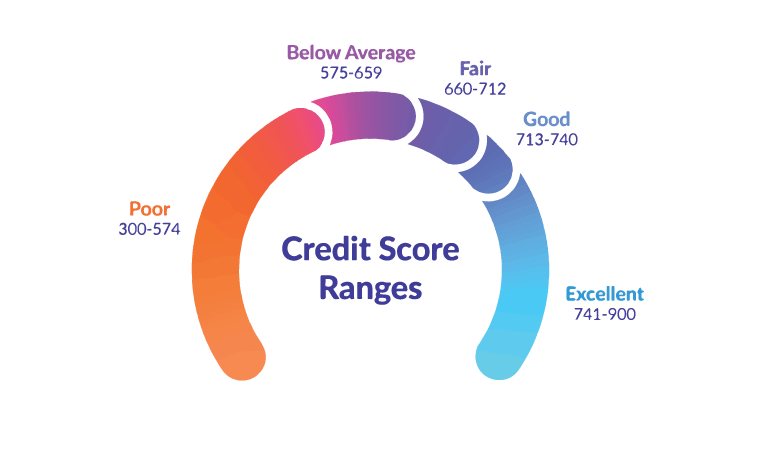

Borrowell uses the Equifax Risk Score 2.0, which essentially calculates your lending risk for businesses. It includes your mortgage and spending data while providing insight into your on-time payment probability. Your score will range from 300 to 900, putting you into one of the following categories:

- 741 or more: An excellent credit score (or a "credit all-star," according to Borrowell)

- 713 to 740: A good credit score that should still allow you to receive good interest rate offerings

- 660 to 712: Considered a fair to average credit score (depending on the lender and how low you are in that range)

- 575 to 659: A below-average credit score that needs improvement

- 300 to 574: A poor credit score (time to seriously focus on improving it)

Your score is based on a few different factors:

- Payment history (on-time or delinquent?)

- Available credit

- Length of credit history

- Number of credit inquiries (how many times lenders checked it)

- Types of credit such as loans and credit cards

Your Borrowell credit check will not negatively impact your score, so check away.

Your Credit Report

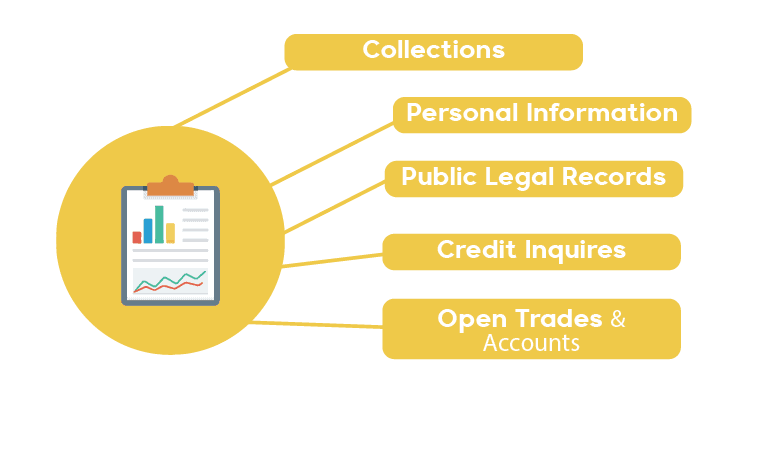

Wondering what the difference is between a credit score and a report? The simple answer: your credit report is a much more in-depth look at your credit history.

Your credit score is a number based on your credit report, which gives lenders an idea of what they should offer you. On the other hand, a full credit report dives deeper and includes your personal information, credit inquiries, and any open accounts such as your mortgage, mobile phone accounts, and more.

Both your credit score and credit report are used by lenders, as each one is a legitimate means of determining creditworthiness.

Credit Monitoring

Borrowell updates your credit score and credit report weekly and will email you whenever it is refreshed. You can print or download your report at any time.

The company also provides the aforementioned AI-powered credit coaching tool, "Molly."

Your personalized credit coach covers some important bases, including:

- Comparing your credit score to see how you stack up against fellow Canadians

- Credit updates, including inquiries and missed payments

- Messages to let you know you're making the right financial decisions

- Tips for how to improve your score, which credit cards are best suited for you, and product recommendations to help you financially

The Borrowell Boost

Do you find yourself constantly missing bill payments? Borrowell's bill tracking feature is designed to help you stay on track.

Here's how it works: you connect your bank account (through the mobile app), and Borrowell analyzes past transactions, identifies recurring bills, and sends alerts when payments are due or if your balance is running low.

Since on-time bill payments account for 35% of your credit score, staying on top of them is an essential way to improve it.

Why Is It So Important to Regularly Monitor My Credit?

Credit monitoring isn't just meant for tracking your score. Think of your credit report as proof to lenders that you can properly manage your finances. (Which gives them a reason to offer you the best interest rates, for example.)

Knowing your credit history and how it's impacted also helps you make smart financial decisions. Let's take a look at everything included on your credit report:

- Personal information

- Any public legal records

- Credit inquiries (you'll see whenever a potential lender reviews your credit)

- Open trades and accounts, such as loans, mortgages, mobile phone accounts, and credit cards (as well as any closed accounts)

- Collections (whenever you have an account that is sent to a collection agency)

- Whether or not you have ever filed for bankruptcy

Keeping track of your credit helps you understand why you have the score you do and which areas of improvement you need to focus on.

Personal Loans Through Borrowell

In addition to free credit monitoring, Borrowell offers personal loan services. There are two ways to secure a personal loan through Borrowell.

Recommended Loans

Borrowell partners with over 50 financial institutions in Canada to match you with the best option for your credit situation. Once you obtain your credit score, the company recommends lenders best-suited for you.

Personal loan options through Borrowell include:

- Car loans

- Business loans

- Debt consolidation

- Major purchases

- Paying off credit cards

- Home improvement projects

After viewing rates and offers, you can choose a lender and complete your application through the Borrowell platform.

Borrowell's Own Personal Loans

Borrowell also offers its own loan product to its users. You can apply for loans between $1,000 and $35,000, in increments of $100. Depending on your credit score, interest rates start at 5.6% APR (for the best credit borrowers). The average Borrowell loan APR is around 11-12%.

These are the general qualifications for acquiring a Borrowell loan:

- Canadian citizen

- A minimum yearly income of $20,000 before taxes

- At least a 12-month credit history

- A 660 credit score or above

- Have a bank account in Canada

If you qualify, you'll receive the option of a 3-year or 5-year loan term. The only fees are a one-time origination fee (1-5%, depending on your loan amount) and a $25-$54 NSF fee (non-sufficient funds) if a payment doesn't go through.

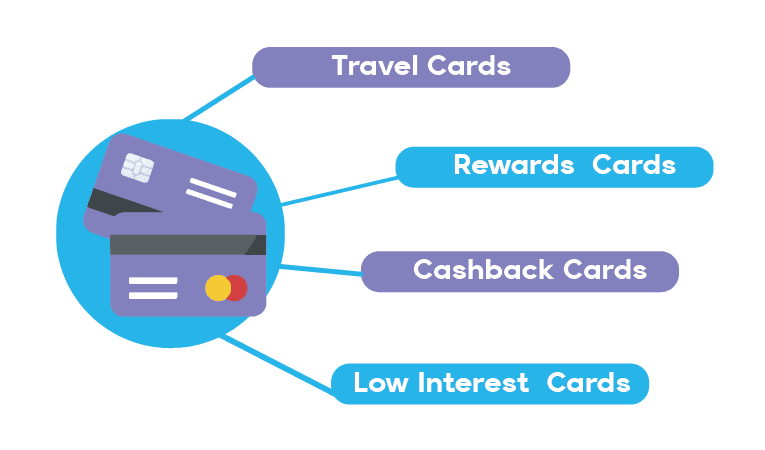

Borrowell's Credit Card Options

Borrowell users have the option to compare and apply for various credit cards through its platform. It also uses your credit profile to recommend the best options for you. The different types of credit cards to compare include:

- Travel cards

- Rewards cards

- Cashback cards

- Cards to help build credit

- Low-interest cards

Some of the company's credit card partners include American Express, BMO, Scotiabank, National Bank, and Capital One. They also offer tips for credit card usage and ways to spend to improve your credit.

Comparing Mortgage Rates on Borrowell

When it comes to mortgages, Borrowell offers more than just rate comparisons. (Of course, that's a big part of it.)

The overall goal of Borrowell is to improve your credit score, which plays a vital role in securing a mortgage loan. If you are looking to buy a home or refinance an existing loan, lenders need reassurance that you are able to borrow and manage credit.

Borrowell's credit monitoring tools are designed to help you get a handle on your credit, and once you do, you're more likely to get approved for a mortgage. Borrowell's mortgage comparison feature pulls your profile to recommend options, along with a mortgage expert to walk you through the process.

There is also a handy mortgage calculator tool to give you a better idea of what you'll owe in monthly payments.

Banking and Insurance Through Borrowell

Rounding out the list of personalized financial options through Borrowell are bank accounts and insurance plans.

Much like comparing the best credit cards or personal loans on Borrowell, you can also compare the best checking accounts, savings accounts, and insurance plans available from its partners. You will also have access to personalized, limited-time promotions exclusive to Borrowell.

The Pros and Cons of Using Borrowell

To recap, let's address some pros and cons of using Borrowell's services:

Pros

- It's free to use (an obvious pro)

- It's a one-stop-shop for financial help (credit monitoring, financial advice, and helpful tools all in one place)

- An easy-to-use platform that can be accessed on a desktop, mobile device, or tablet (including through an app)

- There's no obligation to use their product recommendations

- The company is very transparent about its processes and fees (it is all thoroughly laid out on the website)

- Checking your credit report does not negatively impact your score

- Your personal information is kept safe

Cons

- The NSF (non-sufficient funds) fees for their personal loans are a bit steep

- You can only pay loan payments on a monthly basis

- Personal loan amounts are limited

Is Borrowell Safe to Use?

So, is Borrowell safe? It's only natural to be skeptical of a website that offers free financial help. (There has to be a catch, right?)

By all accounts, Borrowell is a reliable, safe option for credit monitoring and financial services. When it comes to safety, the company confirms that it uses 256-encryption, which is the same level of protection used by big banks. Borrowell will never share the information you provide without your consent.

If Borrowell's Services Are Free, How Do They Make Money?

Great question. (And a fair one.) If Borrowell offers free access to credit scores and financial tools, how do they stay in business?

The company generates revenue by recommending loans, savings accounts, checking accounts, credit cards, etc. If you end up choosing one of their recommended products, Borrowell receives a referral fee. It also earns fees from its own personal loan products.

Borrowell mentions that using the site solely for credit monitoring is completely fine. If you don't find a product that's right for you, the company states it is simply "happy to help you learn about and improve your credit score."

It's Time to Prioritize Your Credit

Now that our Borrowell review has you all caught up on the benefits of credit monitoring, the next step is to take action! Making your credit a priority ensures you receive the best possible options, whether it's for a car loan, new apartment, or in some cases even health insurance.

After checking your credit with Borrowell, we're ready to help you find the best rates for credit cards, insurance, mortgages, personal loans, and bank accounts. We take the guesswork out of shopping for rates online, saving you time, money, and sanity.

Whether you have no credit, bad credit, or are too afraid to check your credit, Insurdinary has the tips and tools you need to improve your financial health. Ready to get started? Learn about financial products in our blog.